All about BONK’s next big move – Is a price hike coming?

Bonk traders are excited about the news of a new listing. Can this propel the memecoin to new heights?

Edited By: Ann Maria Shibu

- Governing council votes on next bonk listing.

- BONK reacted with an increase of over 14%.

Bonk [BONK] could potentially be listed on another exchange, as indicated by an ongoing vote. The latest development has prompted a reaction from the memecoin.

Bonk gets ready for listing

European banking fintech Revolut intends to list Bonk and initiate a $1.2 million campaign to encourage its users to learn about the cryptocurrency. The learn campaign plan was under consideration by BONK’s governing council.

As of the time of this writing, the approval has garnered eight yes votes, surpassing the 75% quorum required for the vote to pass.

Although the vote has been approved, the remaining voting period is still over three days. Once the listing is finalized, it will add to the significant listings that the memecoin has secured in the past few months.

In November, major exchanges such as Binance and Coinbase added BONK to their listings.

Bonk reacts positively

Analysis of Bonk’s trend on a daily timeframe chart revealed a positive response to the latest development. On 14th February, the chart displayed a notable increase of over 14%, marking the second-highest surge in the month thus far.

Additionally, this surge propelled it above 60 on its Relative Strength Index (RSI). At the time of this writing, it was trading with a decline of over 2%, causing its RSI to dip slightly below 60.

Anticipation of a further increase arises with the upcoming listing, as additional user registrations may contribute to heightened trading volume.

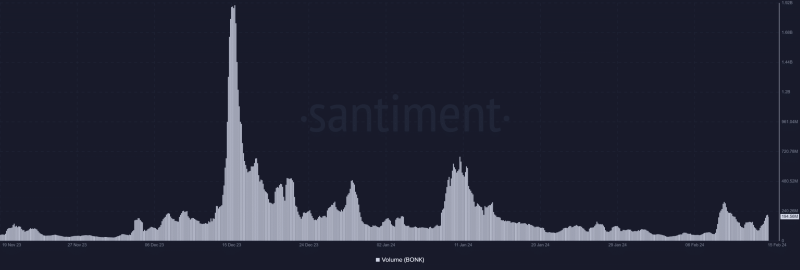

BONK volume sees a slight bump

The volume chart on CoinMarketCap showed that Bonk’s trading volume has surged by over 75% in the last 24 hours. This signaled increased trading activity following the recent development.

Is your portfolio green? Check out the Bonk Profit Calculator

However, when examining the volume trend on Santiment, it becomes apparent that this surge, while notable, does not represent the highest volume observed in recent times.

As of the current writing, the volume stands at around $194 million. A closer look reveals that earlier in the month, its volume surpassed $300 million. The forthcoming listing approval could lead to a substantial increase in both volume and price.