First Mover Americas: Rotation to Altcoins Has Started With Gensler’s Exit Date Set

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Unmute

02:38'High Likelihood' Cardano Founder Charles Hoskinson Will Become Trump's Crypto Advisor

01:22Uptober Forming Amid Rising Stablecoin Liquidity and Bitcoin Transactions

01:30Bitcoin Flat Near $60K Amid Mideast Tensions; XRP Down 10% on Regulatory Uncertainty

01:53North Korea Is Infiltrating the Crypto Industry; Diddy Hires Sam Bankman-Fried’s Appeal Lawyer

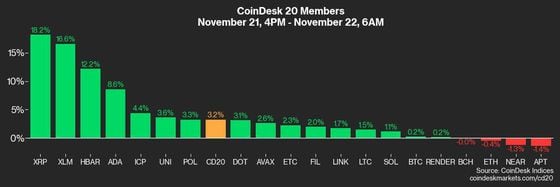

CoinDesk 20 Index: 3,273.75 +7.19%

Bitcoin (BTC): $98,833.89 +1.06%

Ether (ETH): $3,356.95 +1.95%

S&P 500: 5,948.71 +0.53%

Gold: $2,707.27 +1.42%

Nikkei 225: 38,283.85 +0.68%

Top Stories

Bitcoin is inching closer to the $100,000 mark, though its momentum has slowed. It clinched another record on Thursday at $99,500, dipping below $99,000 heading into the U.S. open. BTC has risen 1% over the past 24 hours, while the broad-market CoinDesk 20 Index gained over 7%. Most alternative cryptocurrencies (altcoins) in the CD20 outperformed BTC, an early sign of capital rotation into smaller, riskier tokens as bitcoin’s pace stalls. The $100,000 price point poses a significant resistance level, where investors might take profits on their investments. Still, there’s a possibility of BTC rallying to $115,000 by Christmas, supported by broadening stablecoin supply, inflows into ETFs and bullish options positioning on BlackRock’s spot BTC ETF (IBIT), 10x Research said in a Friday note.

Altcoins are taking their moment to shine as regulatory headwinds look poised to clear. Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC) is set to leave on Jan. 20, President-elect Donald Trump’s inauguration date. Industry participants anticipate that the agency’s new leadership will be more open to approving investment products for smaller tokens and allowing staking for ETFs. XRP led the rally, gaining 33% in 24 hours and Cardano’s ADA rose over 15%. Solana’s native token (SOL) hit an all-time high above $260, the first of the large-cap altcoins to surpass the 2021 market peaks.

Financial service giant Charles Schwab wants to directly offer crypto to users, its incoming CEO said, a sign that U.S. institutions are increasingly emboldened by an expected regulatory sea-change towards digital assets. “We’ve been waiting on a change in the regulatory environment … and we’re confident that we think that will come in short order,” Rick Wurster said in an interview. Also, digital asset manager Bitwise officially joined the race to launch a spot-based solana ETF in the U.S.

Chart of the Day

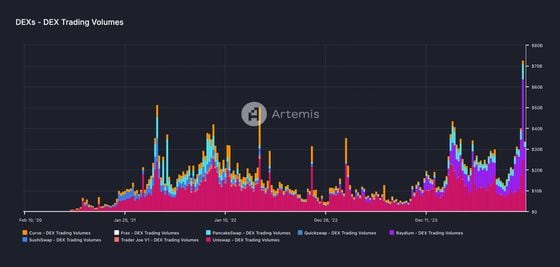

- Traders are increasingly flocking to decentralized exchanges in anticipation of friendlier crypto regulatory policy under Donald Trump’s presidency.

- Volumes on major DEXs surged to a record $72.6 billion last week, with Solana-based Raydium alone accounting for a staggering 44% of the total.

- Source: Artemis

– Omkar Godbole

Trending Posts

MicroStrategy Falls 16% Despite New Bitcoin Record as Some Question Valuation

UK to Draft a Regulatory Framework for Crypto, Stablecoins Early Next Year

Binance Boosts Compliance Staff by 34% Year-Over-Year, Citing Industry’s ‘Rapid Maturation’

Edited by Sheldon Reback.