Bitcoin Spot ETF Approval: Why Price Could Be Set For 300% Surge

BTC Could Surge 300% When A Spot ETF Is Approved

The predictions of Bitcoin experiencing a 300% surge in its price from analysts can be traced back to the growth of Gold over the years after a Spot Gold ETF (SPDR Gold Shares) was approved back in November 2004, and listed on the New York Stock Exchange (NYSE).

The price of Gold had experienced an eight-year consecutive bull run following its first spot gold ETF. Before the listing, the price of Gold as of November 2004, was around $430/oz, and 3 years later, the numbers had doubled.

Fast-forward to the end of 2011, the price of gold was already trading at $1,800/oz indicating a 300% surge in price. Currently, the price of gold is closely gaining on its highest peak price of $1,977/oz, bolstered by geopolitical tensions in the Middle East.

Gold moves slowly and steadily, and it is significantly less volatile than Bitcoin, but analysts anticipate the price of Bitcoin is likely to reach $120,000 in the next couple of years if the digital asset manages to reiterate the movement of Gold since its spot gold ETF approval. If the Bitcoin price were to follow this same pattern, then it could hit $100,000.

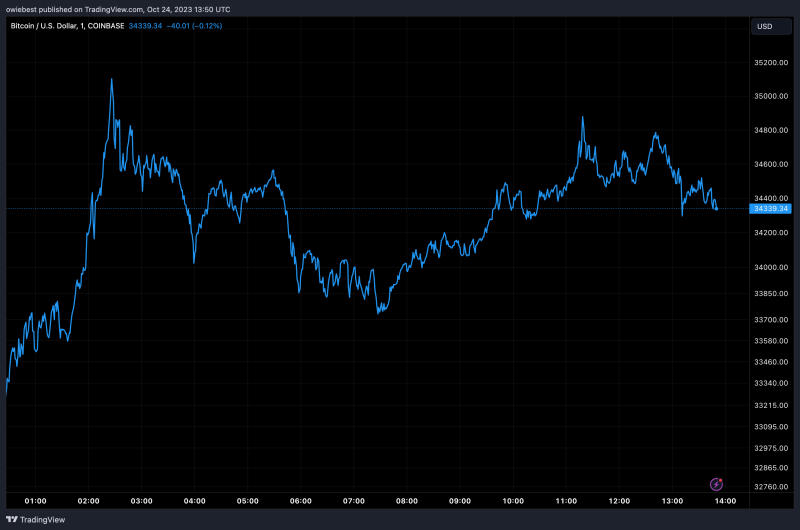

Recently, Bitcoin has achieved its highest price peak of $35,000 since May 2022. The recent increase in price can be traced back to the propaganda and excitement encompassing a spot Bitcoin ETF approval. However, the digital asset is still 50% down from its all-time high in 2021.

Last week, Bitcoin experienced a whirlwind rise of over 10% within minutes after a false report was released by Cointelegraph that a spot Bitcoin ETF had been approved by the SEC. However, the digital asset’s price later fell almost immediately after the report was proven to be false by Blackrock’s Chief Executive Officer Larry Fink.

Its significant market movement this week has prompted analysts to enter “price prediction mode.” The breakout was anticipated by cryptocurrency expert Mags for the end of the year. In addition, a decline below $30,000 is anticipated within the following few months.

Analysts believe that this will be the last area of accumulation before a significant breakout that would see the asset rise up to $50,000 prior to the halving.

Bitcoin Spot ETF Boasts Higher Chance Of Approval

Recently, analysts have predicted a spot Bitcoin ETF to be approved by January 2024, due to the recent developments following the approval of a Spot Bitcoin ETF by the SEC.

Bloomberg crypto analyst James Seyffart shared his team’s prediction of a spot Bitcoin ETF approval on his official X (former Twitter) handle. The team believes that there is a 90% chance of approval of a spot Bitcoin ETF by January 10, 2024.

The team’s prediction came amidst ARK 21Shares Bitcoin ETF filling that had been updated with 5 new pages. The move suggested a “constructive conversation” with the SEC, an indication that an investment fund is likely to be approved soon.

Featured image from Leadership News, chart from Tradingview.com