Bitcoin fees hit 3-month low: A $12M drop, explained

The reduced demand for the Bitcoin network post-halving has led to a significant drop in its fees.

Edited By: Saman Waris

- Bitcoin’s total fees have dropped to a three-month low.

- Due to this, miners’ revenue derived from fees has declined.

Bitcoin [BTC] network fees have fallen to a record low as the Layer 1 (L1) transaction volume continues to decline.

In a post on X (formerly Twitter), on-chain data provider IntoTheBlock noted that transaction fees on the Bitcoin network plunged to their lowest level in three months this week.

Recording a weekly transaction fee totaling $12 million, the network saw a 45% decline from the previous week.

State of the network

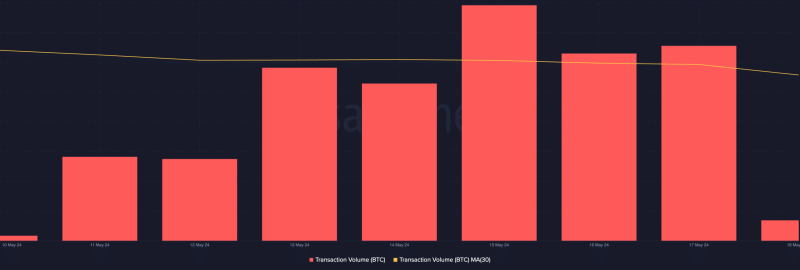

This week’s decline in the Bitcoin network’s fee is due to the decrease in its transaction volume.

According to Santiment’s data, the aggregate amount of BTC across all transactions completed on the network fell steadily during the week.

Between the 11th and the 17th of May, Bitcoin’s transaction volume plummeted by 5%.

The average fee paid per transaction dropped as the network saw a decline in demand. According to Messari, this decreased by 17% during the period under review.

At press time, the average cost of executing a transaction on the Bitcoin network was $2.56.

The miners on Bitcoin’s network are the primary victims of its low network fees.

After the percentage of miner revenue derived from transaction fees rallied to a year-to-date high of 75% on the 20th of April, post-halving event, it has since declined significantly.

As of this writing, only 4% of miner revenue is derived from the fees paid by Bitcoin’s users. This marked a 95% decline from the YTD high, per Messari’s data.

Miners offload coins to prevent losses

Low revenue and BTC’s recent price troubles have forced some miners to sell their holdings.

AMBCrypto assessed Bitcoin’s Miner Supply Ratio and found that it has fallen by 0.21% since the halving event.

This metric measures miners’ BTC holdings relative to the coin’s total supply. When it declines this way, miners are selling a larger portion of their mined coins.

This is often due to capitulation from high operational costs, the desire to take profit, or a lack of confidence in the coin’s price.

Is your portfolio green? Check out the BTC Profit Calculator

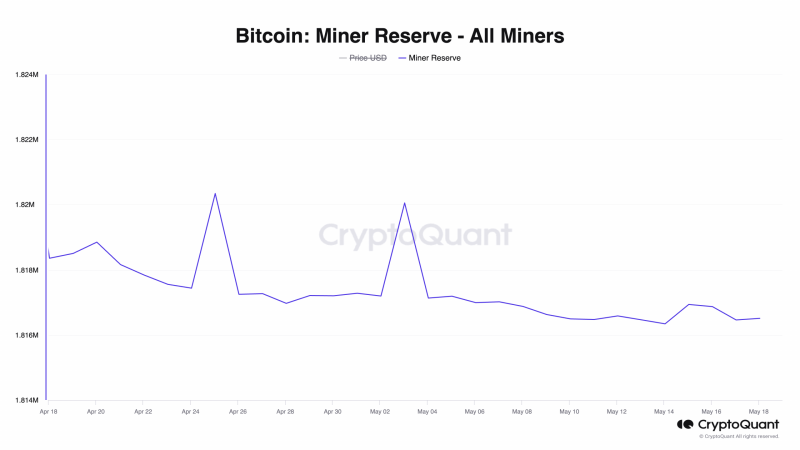

BTC sell-offs among miners on its network have led to a depletion of the coin’s Miner Reserve. This measures the amount of coins held in miners’ wallets within a specified period.

According to CryptoQuant’s data, BTC’s Miner Reserve, at 1.81 million at press time, has dropped by 1% since the 25th of April.