Bitcoin Slides to $28.3K After Leveraged Funds Ramp Up Bearish Bets

- Bitcoin runs into selling pressure as Wall Street turns risk averse.

- Leverage funds are most bearish in bitcoin futures since April 2022.

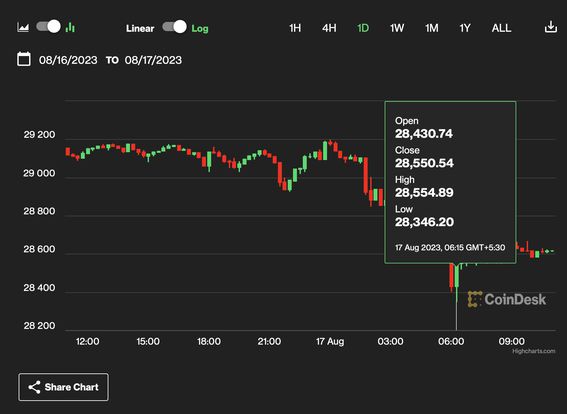

Bitcoin (BTC) woke up from its deep slumber early Thursday but not in ways the bulls would have liked to see.

The leading cryptocurrency slipped to $28,346, the lowest since June 21, extending Wednesday’s 1.6% slide that mirrored risk aversion on Wall Street. U.S. stocks fell Tuesday on renewed banking sector concerns and China recession fears.

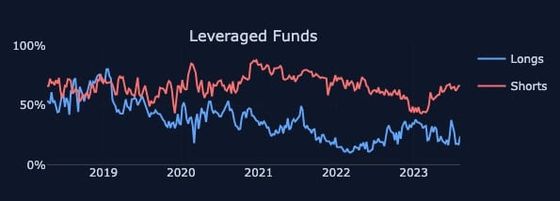

The downside volatility in BTC comes days after the U.S. Commodity and Futures Trading Commission’s (CFTC) report on commitment of traders (COT) showed leveraged funds – hedge funds and commodity trading advisors – ramped up bearish bets in the CME-listed cash-settled bitcoin futures in the week ended Aug. 8.

“Two-thirds of their positions are short (shown in red) versus one-third long (shown in blue). That’s the widest it’s been in since April 2022,” Lawrence Lewitinn, director of content at crypto analytics firm The Tie’s, said in a weekly newsletter.

Perhaps sophisticated traders are worried about potential spillovers from murky macro outlook and rising nominal and inflation-adjusted U.S. government bond yields.

Besides, the crypto market has been indifferent to recent positive crypto-specific developments like the launch of a stablecoin by PayPal, one of the largest financial services companies in the world and a string of applications for futures-based exchange-traded funds (ETFs) tied to ether (ETH).

“Whether that’s one of the largest financial services companies in the world launching a stablecoin using public blockchain infrastructure or renewed excitement for futures-based ETH ETFs on the back of a flurry of new applications, both volatility and volume metrics continue to drop to multi-year lows,” David Lawant, head of research at institutional trading desk FalconX, said in a market update.

“Overall, while the improving trends and fundamentals in crypto continue to sustain optimism, it’s a good time to keep a close eye on any potential spillover impacts from macro to broader risk assets and, by extension, crypto,” Lawant added.

Bitcoin’s renewed downside volatility is consistent with its record of putting interim tops after notable rallies in meme coin SHIB. The self-proclaimed dogecoin-killer surged over 20% in the first 12 days of the month, predominantly on optimism that a layer 2 Shibarium launch would help the cryptocurrency revamp its image as a serious industry player.

Since Aug. 12, the cryptocurrency has pulled back 18%, with prices falling 9% in the past 24 hours alone amid Shibarium’s turbulent start. Funding rates in SHIB perpetual futures trading on Binance have crashed to a two-month low of -0.084%, according to data source Coinglass.

The negative figure indicates that shorts are paying longs to keep their bearish positions open. In other words, leverage is skewed bearish.

Edited by Parikshit Mishra.