Bitcoin’s 2024 outlook should concern you: Here’s why

As long-term sentiment around BTC remains bullish, upcoming events can impact prices.

- Long-term holders are adding to their holdings.

- An analyst opined that the BTC may not react quickly to a potential ETF approval.

Despite Bitcoin’s [BTC] sideways movement, AMBCrypto learned that long-term holders are still accumulating. This revelation was made known by CryptoQuant’s verified author JA Maartunn on X (formerly Twitter).

“Conviction” is the name of the game

The increase was proof that those who have experienced the ups and downs of the market are bullish on the BTC price action. At press time, Bitcoin changed hands at $42,485. This value represented a 1.72% decrease in the last seven days.

One of the reasons these holders are bullish could be because 2024 is the Bitcoin halving year.

The Bitcoin halving year is considered an important event on the crypto calendar. This is done by cutting the Bitcoin mining reward into two to reduce the number of coins entering the network.

When this happens, the demand for BTC increases afterward.

Also, in past cycles, the Bitcoin price reaches a new All-Time High (ATH) months after the halving. So, the sentiment around the coin might be valid, especially as this year’s event is billed for April.

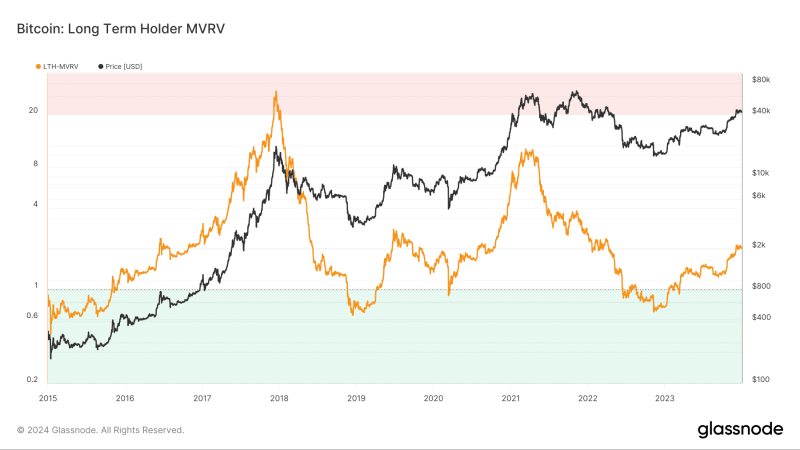

As a result of the recent occurrence, AMBCrypto checked the Long Term Holder-Market Value to Realized Value (LTH-MVRV) ratio.

At press time, Glassnode data showed that LTH-MVRV jumped from 0.74 to 2.0 between the 1st of January 2023 to the 31st of December.

The LTH-MVRV serves as a macrocycle indicator to assess the sentiment of long-term holders within a 155-day window. Historically, anytime the metric hits a double-digit reading of 10, long-term holders become bearish.

This was evident from the happening of December 2017 and April 2021.

During both periods, long-term holders liquidated their holdings. This also caused a correction in the BTC price. Therefore, the LTH-MVRV means that HODLers are confident of a Bitcoin bullish price action for most of the new year.

BTC’s future remains a bright one

Another metric worth considering is the Stablecoin Supply Ratio (SSR). High values of the SSR suggest low stablecoin supply, indicating potential sell pressure and a price decrease.

However, Low values indicate potential buying pressure and a possible price rise.

Looking at the data from CryptoQuant, the SSR in the last 30 days had fallen to 12.31. This reading implies that the market is armed enough to get BTC to a new ATH.

However, it is also noteworthy to mention that it might not happen in the short term.

Meanwhile, Gabor Gurbacs commented on Bitcoin’s short and long-term outlook. Gurbacs, an advisor at U.S. asset management firm VanEck, noted that the initial impact of the spot ETF approval might be minimal.

He, however, advised players to check the history of gold, as that would give an idea of Bitcoin’s long-term potential.

In my view, people tend to overestimate the initial impact of U.S. Bitcoin ETFs. I think maybe a few $100mm flows (mostly recycled) money.

Long term, people tend to underestimate the impact of spot Bitcoin ETFs. If history is any guide, gold is worth studying as a parallel. https://t.co/6vvkA9aC09

— Gabor Gurbacs (@gaborgurbacs) December 31, 2023

Realistic or not, here’s BTC’s market cap in ETH terms

In his concluding post on X, the strategy advisor wrote:

“People tend to hype the current thing but remain myopic about the big picture. Bitcoin is forcing its own capital markets systems and products well beyond the ETF and that’s not priced in. The question is not what BlackRock adopts, but what Bitcoin company is the next BlackRock.”