Bitcoin’s Share in Crypto Futures Trading Slides as Altcoin Profits Allure Traders

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

Crypto traders are increasingly looking to alternative cryptocurrencies as 2023 draws to a close.

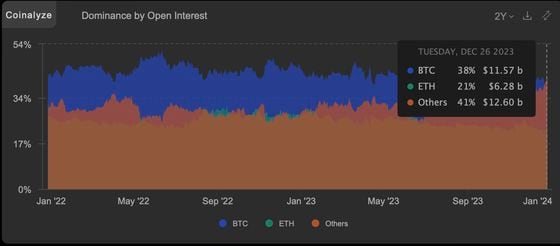

The dollar value locked in the number of active futures contracts tied to bitcoin now accounts for 38% of the market-wide notional futures open interest of $30.45 billion. That’s the lowest in at least two years, according to data tracked by Coinalyze.

“Seems ‘all’ the money is going into alts now,” Coinalyze told CoinDesk, explaining the decline in BTC’s dominance by open interest in futures.

The data show renewed risk appetite in the crypto market typically observed after a notable bitcoin uptrend.

Bitcoin, the leading cryptocurrency by market value, has surged over 60% to $43,100 since Oct. 1, mainly due to dwindling Treasury yields and expectations that the U.S. Securities and Exchange Commission would soon approve one or more spot BTC ETFs.

As of writing, BTC was up 161% on a year-to-date basis, and ether, the second-largest cryptocurrency, traded 88% higher.

BTC’s dominance by futures open interest has declined from nearly 50% in late October to 48%. ETH’s dominance has remained steady at nearly 21%, while the share of altcoins has increased from 32% to 41%.