Dogecoin Jumps 10%, Outperforming on Trump Popularity as Bitcoin Nears $70K

Bitcoin (BTC) rose to a three-month high on Monday, approaching the $70,000 level and moving to within about 5% of its record high of $73,700 from last March.

BTC advanced 3% over the past 24 hours, changing hands at $69,800, while the CoinDesk 20 Index, which tracks the performance of 20 large-cap tokens, managed a more modest 1% gain during the same period. Ethereum’s ether (ETH) was up 0.5%, while native tokens of Polygon (POL), Near (NEAR) and Hedera (HBAR) dragged the index lower.

Unmute

02:28Trump Pumps DeFi Token Sale; Bitcoin Price Jumps Above $65K

01:22Uptober Forming Amid Rising Stablecoin Liquidity and Bitcoin Transactions

01:01Bitcoin Breaks $64K While Gold Soars

02:01Trump-Endorsed Crypto Project Confirms Plan for a Token; Bhutan Holds Over $780M in Bitcoin

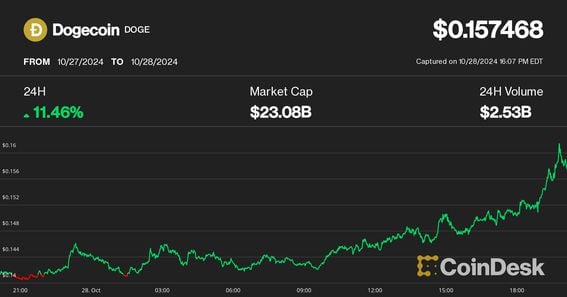

It was dogecoin {DOGE}} that defied the broadly lagging altcoin market, surging 10% during the day, as the token attracted trader attention after being mentioned during a Donald Trump campaign event on Sunday.

The largest and oldest market cap canine-themed crypto has been closely associated with Trump lately after Elon Musk, who has been increasingly involved with the Republican candidate’s campaign, proposed the “Department of Government Efficiency,” abbreviated to D.O.G.E., focused on reining in U.S. government spending.

Excitement rose a bit further as Musk, following his appearance at the Trump rally, tweeted a meme of himself with the DOGE avatar.

“It’s a play on Trump’s popularity,” Paul Howard, senior director at crypto trading firm Wincent, said in a Telegram message. “DOGE is now being closely tied to the U.S. presidential outcome by virtue of its popularity with [Elon] Musk.

Bettors on blockchain-based prediction market Polymarket now give a nearly 66% chance for Trump to win the U.S. presidential election next week, up from 61% a week ago.

The crypto action happened as U.S. stock indexes closed the day higher, with the Dow Jones climbingby 0.7%, while the Nasdaq’s and the S&P 500 each gained 0.3%. Crude oil prices tumbled more than 5% after Israeli airstrikes against Iran didn’t hit oil facilities, allaying concerns of escalation in the Middle East.

Bitcoin setup mirrors late 2020

There could be more gains ahead, as BTC’s current setup resembles late 2020’s big rally to all-time highs, according to Matthew Sigel, head of research at asset manager VanEck.

“This is a very bullish setup for bitcoin into the election,” Sigel said on Monday in an interview with CNBC.

“We saw the exact same pattern in 2020 when bitcoin lagged with low volatility and once the [election] winner was announced, we had a high vol rally as new buyers came in,” he added.

BTC surged roughly 120% between the 2020 November election and the end of the year.

Edited by Stephen Alpher.