Ethereum Price On The Verge Of Rectangle Pattern Breakout: Is $2000 Within Reach?

Over the past few days, the Ethereum price has remained relatively stable, with minor gains seen on the daily chart. Meanwhile, Bitcoin’s indecisiveness has resulted in slower movement for altcoins.

Despite this, Ethereum has risen on its chart, although the technical outlook suggests low demand and accumulation due to reduced buying strength.

Despite the fall in buying strength, buyers still hold an advantage over sellers in the market. However, if Ethereum fails to move above its immediate resistance, the coin may retrace on its chart, potentially falling below its local support level and activating bearish sentiment.

Investors are now looking ahead to the release of US CPI data, which analysts predict will significantly impact the market in the coming weeks. The market capitalization of Ethereum has fallen slightly, indicating slow demand for the altcoin.

Ethereum Price Analysis: One-Day Chart

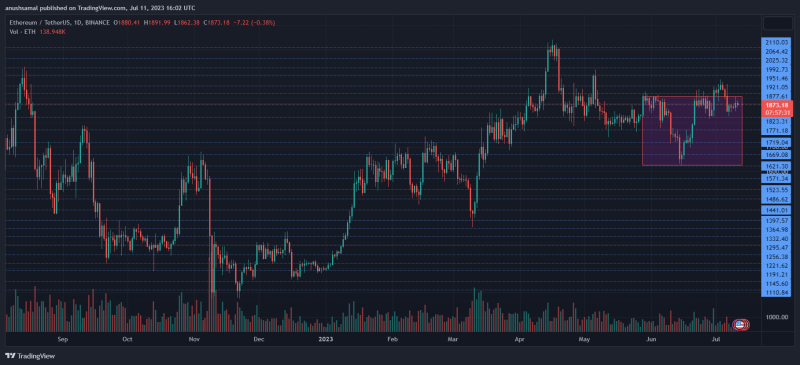

At the time of writing, ETH was priced at $1,870. The daily chart indicated a potential breakout as the price approached the upper boundary of a rectangle pattern. The crucial overhead resistance for Ethereum was identified at $1,880.

If the price managed to surpass this level, it could potentially exceed $1,900 and ultimately reach the milestone of $2,000.

However, it was essential for ETH to surpass the $1,880 mark in the upcoming trading sessions. On the downside, there was a local support level of $1,820. A dip below this point could lead to a decline towards $1,770.

Technical Analysis

The inability to break through the $1,900 level had a detrimental impact on investor confidence, resulting in ongoing challenges for Ethereum regarding demand on the daily chart. The Relative Strength Index (RSI) remained positive, although it suggested a relatively low level of demand.

Furthermore, Ethereum’s current position below the 20-Simple Moving Average line indicated a decline in buying strength, indicating that buyers were gradually losing control of the price momentum.

In addition to the low buying strength, ETH also experienced a decline on capital inflows. This indicated a decline in investor interest, as evidenced by the Chaikin Money Flow indicator.

Conversely, the Moving Average Convergence Divergence (MACD) formed declining red histograms, suggesting a potential breakout in the upcoming trading sessions. The MACD is a useful tool for identifying price momentum and trend changes.

The next trading sessions will be critical for ETH. It will determine whether the market will be driven by bears or bulls, ultimately influencing the price.

Featured image from UnSplash, charts from TradingView.com