Ethereum: Traders looking for a green signal should read this

Although Ethereum’s exchange outflow and inflow reached a five-year and seven-year low, other metrics displayed that ETH could witness bearish price action only in the near future.

- ETH’s price remained above its realized price, which hovered between $1,500 and $1,600.

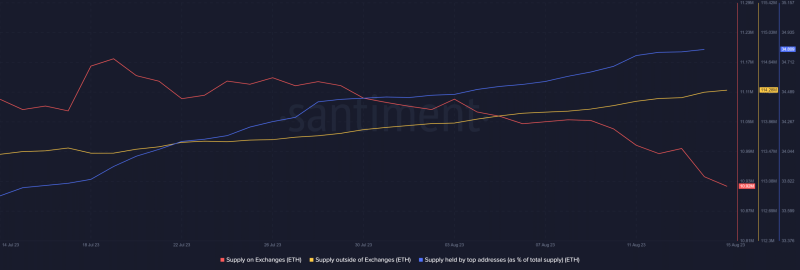

- Ethereum’s supply on exchanges declined while its supply outside of exchanges shot up.

As the market is witnessing less activity, Ethereum’s [ETH] price has continued to stay under the $1,900 mark. Therefore, investors might want to accumulate more ETH before the token enters its next bull rally.

Interestingly, CryptoQuant’s latest analysis sheds light on when investors should consider accumulating the altcoin. However, a look at a few metrics suggested that buying pressure around ETH was relatively weak.

This indicates good buying opportunities

A CryproQuant analyst and author recently posted an analysis that highlighted a metric to mention when investors should stockpile ETH. As per the analysis, Ethereum’s realized price hovered between $1.500 and $1,600 from January to August 2023. This is the average “break-even” price at which Ethereum holders make no money or lose money.

When ETH‘s price falls below the realized price and quickly recovers, it indicates that the market believes Ethereum is undervalued. Thus, there were three buying opportunities year-to-date, after which the token’s price rallied.

According to CoinMarketCap, at press time, ETH was trading at $1,840.24 with a market capitalization of over $221 billion. This meant that at press time, ETH’s price was above its realized price, suggesting that it was not undervalued.

Interestingly, Glassnode Alerts’ tweet pointed out that ETH’s exchange outflow reached a five-year low of 6,045.499 ETH.

At first glance, this looked bearish, but upon a thorough check, a different story was revealed. Not only did exchange outflow, but ETH’s exchange inflow also reached a seven-month low. A drop in both metrics clearly indicated that investors were reluctant to trade ETH.

Should investors start accumulating ETH?

Though the overall market remained dormant, a look at ETH’s metrics suggested that investors might have already started accumulating. The token’s supply on exchanges dropped over the last month, while its supply outside of exchanges increased. Moreover, ETH’s supply held by top addresses also shot up, reflecting whales’ confidence in the token.

Considering that ETH has become comfortable under $1,900, investors might as well think about increasing their accumulation ahead of a bull run to enjoy profits. This was because the chances of ETH continuing its sluggish price action seemed likely but only in the short term.

Additionally, Coinglass’ data revealed that ETH’s open interest was relatively high. Moreover, its funding rate was also green.

A high funding rate means that derivatives buyers were purchasing ETH at its current price. This increases the chances of a continued price trend.