Ethereum: With churn limit on the rise, will ETH ditch the bears?

Ethereum, despite recent price challenges, increased its Churn Limit from 11 to 12, prioritizing network scalability and security.

- Ethereum increased the Churn Limit to 12, aiming to enhance network scalability and security.

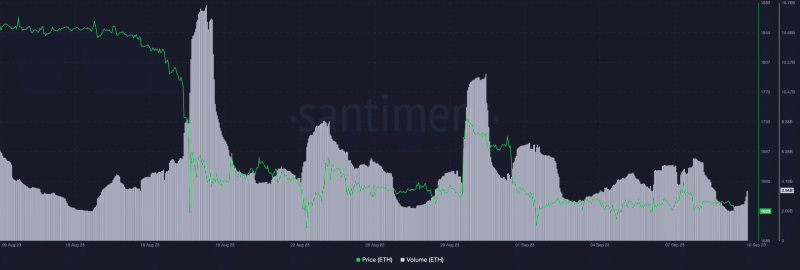

- The price of ETH declined along with its volume.

Ethereum[ETH], despite its recent struggles in achieving positive price momentum, has been actively working on network improvements. One notable development was the increase in Ethereum’s Churn Limit, which saw a recent rise from 11 to 12. This adjustment is part of ongoing efforts to enhance the network’s efficiency and scalability.

Is your portfolio green? Check out the Ethereum Profit Calculator

Rising Churn Limit

The Churn Limit plays a crucial role in Ethereum’s blockchain, as it regulates the number of validators allowed to join or exit the network within a specific timeframe. By increasing this limit, Ethereum aims to accommodate more validators, thereby strengthening network security and decentralization.

Yesterday, the churn limit increased from 11 to 12. Next churn limit increase projected to occur around October 4!

H/t: @dapplion pic.twitter.com/ftwhRxbGFE

— Christine Kim (@christine_dkim) September 11, 2023

However, it’s essential to consider the Ethereum entry queue’s behavior. This queue, which represents validators waiting to join the network, has been gradually decreasing since its peak on 10 June. The ongoing trend suggested that if no new validators join the network by the end of September, the number of pending validators could return to zero.

Despite these challenges, Ethereum has been making notable improvements in terms of its Churn Rate, reflecting the network’s dedication to optimization. Furthermore, the number of Ethereum validators also grew from 880,000 to 924,024, showcasing a continued interest in supporting the network’s security and operations.

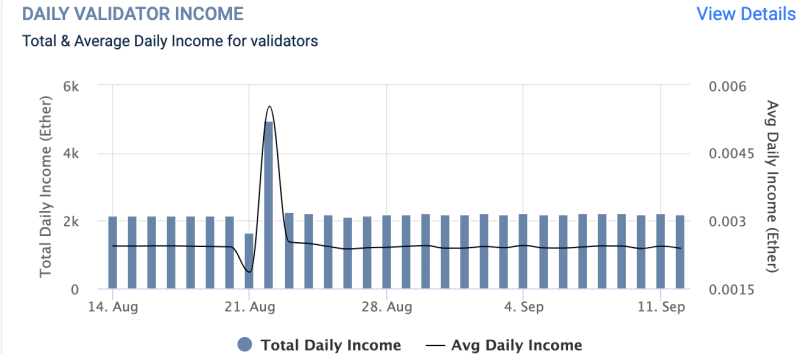

State of the validators

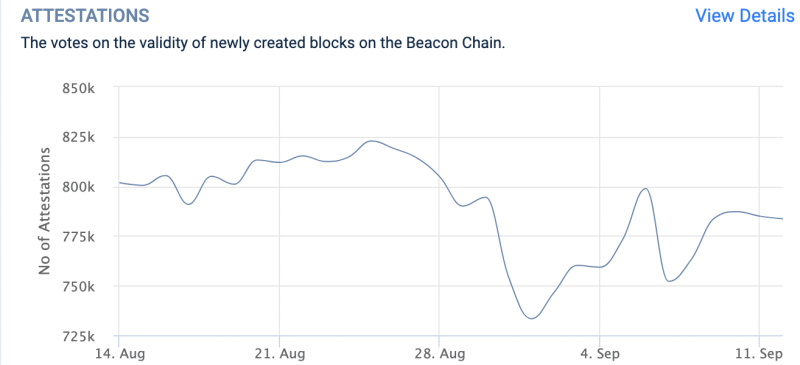

Validator Attestations, vital for confirming transactions and maintaining Ethereum’s blockchain integrity, witnessed a decline in the past month. These attestations serve as a critical aspect of Ethereum’s security framework and require careful monitoring to ensure the network’s reliability.

However, daily validator income has shown limited growth, with an average daily income of $0.000236 ETH. This income level may not be attractive enough to incentivize potential validators to participate actively, potentially slowing down network expansion.

In parallel to these technical challenges, Ethereum’s market performance has faced hurdles. The price of Ethereum remains below $1,623, and trading volume also decreased. Thus, contributing to the overall uncertainty within the Ethereum community.

Realistic or not, here’s ETH’s market cap in BTC’s terms

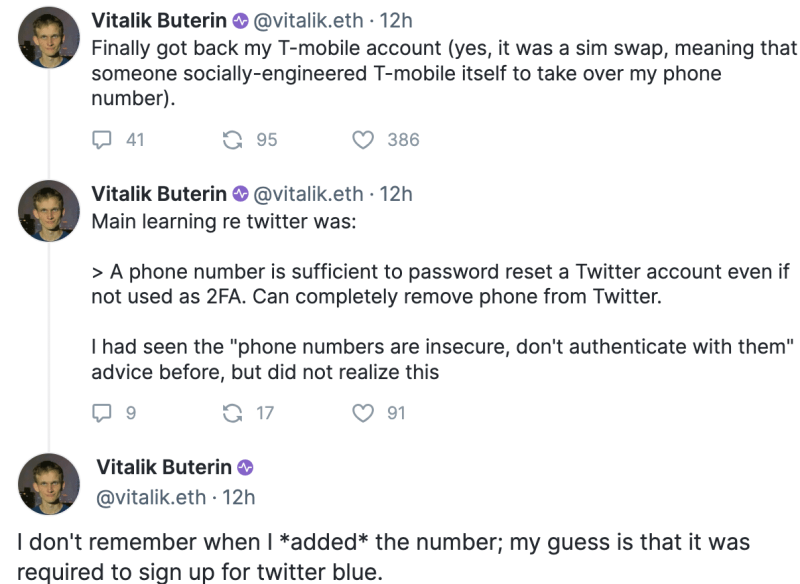

Furthermore, Ethereum experienced a setback when Vitalik Buterin’s Twitter account was compromised in a security breach. It was later confirmed that a SIM swap attack was used to gain unauthorized access to his account, involving manipulation of the telecom company T-Mobile to access his SIM card.