First Mover Americas: Bitcoin Slips Below $39K

Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin slipped below $39,000 during the European morning, its lowest level since the start of December, as institutional sales tied to recently launched ETFs continue to weigh down BTC. CoinDesk 20, a liquid index that tracks the highest tokens by capitalization, fell nearly 6%, indicative of average declines in the broader crypto market. Analysts at crypto exchange Bitfinex said in a Tuesday note that the recent slump in bitcoin prices had wiped out gains for short-term investors – with realized losses increasing, adding to a market drop. “Many holders, especially those who acquired BTC less than a month ago, are now exiting the market at a loss,” the analysts said. “Such a substantial decrease in average profits for short-term holders, who tend to react more acutely to short-term market fluctuations, can be a precursor to selling pressure or exit liquidity.”

FTT, the native token of bankrupt crypto exchange FTX, bucked the trend of the wider market to rise as much as 11% after CoinDesk reported that FTX’s bankruptcy estate had dumped 22 million shares of Grayscale’s GBTC bitcoin ETF. These were worth nearly $1 billion and accounted for almost half of all GBTC sales since the product went live early this month. FTT tokens have been largely a speculative instrument since FTX’s collapse, but plans of an FTX restart or creditor repayments have previously caused brief price spikes. FTT trading volumes jumped to $90 million from Sunday’s $22 million, CoinGecko data shows.

Donald Trump reiterated his opposition to central bank digital currencies (CBDCs) at a rally in Laconia, New Hampshire Monday Night, crediting former Republican candidate Vivek Ramaswamy for the policy. “Vivek wanted this: I will never allow the creation of a Central Bank Digital Currency,” Trump said. He had previously called a digital dollar a dangerous threat to freedom…giving a federal government absolute control over your money.” Digital assets have not been a central issue in the 2024 U.S. presidential race but have kept reappearing in the spotlight as a peripheral topic by Republican candidates. Still, with recent candidate dropouts, its prominence in discussions may further diminish.

Chart of The Day

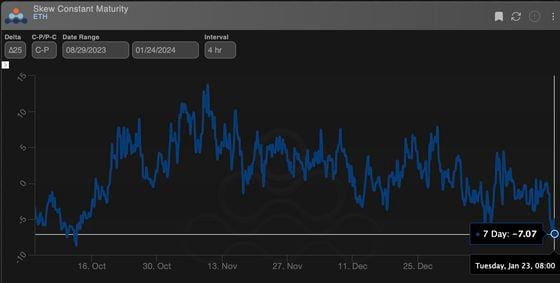

- The chart shows a seven-day call-put skew for ether since October.

- The metric has dropped to -7%, the lowest in three months, indicating a bias for puts or options allowing buyers to profit from or hedge against price slides.

- Source: Amberdata

– Omkar Godbole

Trending Posts

- SEC Shut Off Extra Security on X For About 6 Months, Letting Hacker Breeze In

- Bottom Fishing in Bitcoin? Here Are the Key Signs To Watch For

- Congresswoman Maxine Waters Questions Meta’s Ongoing Crypto Efforts

Edited by Omkar Godbole.