First Mover Americas: BTC Post-Halving – Remember the Macroeconomy: Goldman Sachs

Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin’s fourth mining-reward halving is just two days away. The quadrennial event will reduce BTC’s per block emission to 3.125 BTC, cutting the pace of new supply by 50%. Previous halvings preceded massive multimonth rallies in BTC, and the crypto community is confident history will repeat itself. Investment banking giant Goldman Sachs, however, cautioned its clients from reading too much into the past halving cycles. “Caution should be taken against extrapolating the past cycles and the impact of halving, given the respective prevailing macro conditions,” Goldman’s Fixed Income, Currencies and Commodities (FICC) and Equities team said in a note to clients on April 12. The macroeconomic environment on those occasions differed from today’s high inflation, high-interest rate climate.

According to broker Bernstein, the “miner fear factor” is at its peak ahead of the halving, and investors should buy outperform-rated Riot Platforms (RIOT) and CleanSpark (CLSK) because the market will reward these companies for their superior execution and for being market leaders by self-mining hashrate. Bernstein notes in a research report that mining stocks have continued to underperform bitcoin (BTC) year-to-date as the halving raised concerns over profitability once the rewards are slashed. The event is due around April 19-20. Hashrate refers to the total combined computational power that is being used to mine and process transactions on a proof-of-work blockchain. “Historically, bitcoin price breakout has always followed the halving event and sometimes a few months after halving,” analysts Gautam Chhugani and Mahika Sapra wrote.

U.S. Senators Cynthia Lummis (R-Wyo.) and Kirsten Gillibrand (D-N.Y.) are taking another swing at crypto-specific legislation, with a narrowly tailored bill seeking to define how stablecoins – cryptocurrencies that maintain value with some other asset or currency – will operate in the U.S. The lawmakers unveiled a new stablecoin bill Wednesday in the latest effort to create legislation directly addressing this corner of the crypto market. Under their proposed bill, payment stablecoin issuers would have reserve and operational requirements, including needing to create subsidiaries specifically to issue stablecoins. The bill would also require stablecoin issuers to deal in dollar-backed tokens.

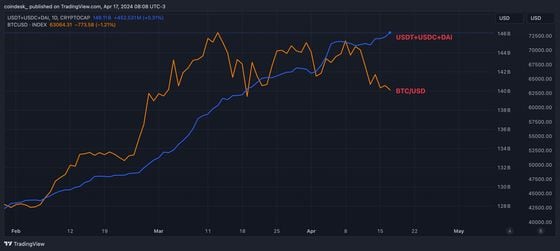

Chart of the Day

- The chart shows that while bitcoin’s rally has stalled, the combined market cap of the top three stablecoins, USDT, USDC and DAI, has risen to a record $146 billion.

- The continued expansion in the supply of stablecoins, a proxy for liquidity, is a positive sign for the crypto market.

- Source: TradingView

Trending Posts

- Ether Options Show Bias for Weakness Over 3 Months

- P2 Ventures Commits $50M Via Hadron FC to Startup Founders in Polygon Ecosystem

- UK Lawmakers Call for Govt to Develop Crypto, Blockchain Skills Pipeline