First Mover Americas: dYdX Beats Uniswap, Bitcoin Outlook Dour

Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Headwinds for bitcoin (BTC) continue to linger and could contribute to prices falling lower in the coming days, despite the apparent early successes of several U.S.-listed spot exchange-traded funds (ETFs). Bitcoin prices fell as low as 15% after the much-awaited ETF listing last week, with outflows from Grayscale’s Bitcoin Trust product said to contribute to the downward pressure. ETF volume data provided by BlackRock (BLK), Fidelity and Bitwise cumulatively crossed the $500 million mark earlier this week – indicating demand from regulated funds and professional traders. Coinbase (COIN), the custodian for several ETF providers, saw record-high OTC desk transfer volumes. “Several on-chain metrics and indicators still suggest the price correction may not be over or at least that a new rally is still not on the cards,” CryptoQuant analysts said. “Short-term traders and large bitcoin holders are still doing significant selling in a context of “risk-off” attitude.

Decentralized exchange dYdX, which recently migrated from Ethereum to Cosmos, has replaced one of Uniswap’s markets as the largest DEX by daily trading volume, according to data from CoinMarketCap. The Cosmos-based v4 version of dYdX just saw $757 million of volume over a 24-hour period, topping Uniswap v3, which had $608 million, the data shows. dYdX’s v3 market, which still operates, had $567 million, enough for third place. According to dYdX, the total trade volume so far for its v4 market since launch is $17.8 billion. In 2023, dYdX’s v3 saw a total of over $1 trillion in trading volume, with several days exceeding $2 billion of trading volume.

Former President and front-runner in the Republican leadership race, Donald Trump, has promised to ban the creation of a central bank digital currency (CBDC) during a campaign stop in New Hampshire. “As your president, I will never allow the creation of a central bank digital currency,” Trump said on stage, joined by crypto-friendly former candidate Vivek Ramaswamy, who recently suspended his campaign. “This would be a dangerous threat to freedom, and I will stop it from coming to America,” Trump continued. “Such a currency would give a federal government absolute control over your money. They could take your money, and you wouldn’t even know it was gone.”

Chart of The Day

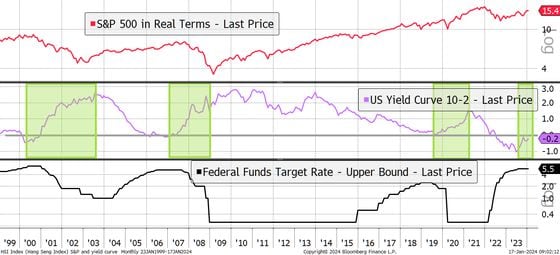

- The chart shows the S&P 500 in inflation-adjusted terms, the spread between U.S. 10 and two-year Treasury bond yields, and the Fed funds rate (the benchmark borrowing cost) since 1999.

- Fed’s pivot to rate cuts or renewed liquidity easing typically comes from the point of economic weakness, coinciding with a bearish trend reversal and a sell-off in the S&P 500, as observed in 2000, 2008, and late 2019.

- The market expects the Fed to cut rates by over 100 basis points this year.

- Source: ByteTree Research, Bloomberg

– Omkar Godbole

Trending Posts

- Sui Teams Up With Oracle Stork to Provide Builders With Fast Pricing Data

- Investment Firm With $1B Assets Looks to Invest in Bitcoin Mining With Fabiano Consulting

- TrueUSD Wobbles Towards $1 Peg Amid Reported Redemption Issues

Edited by Omkar Godbole.