First Mover Americas: It’s ETF Deadline Week

Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

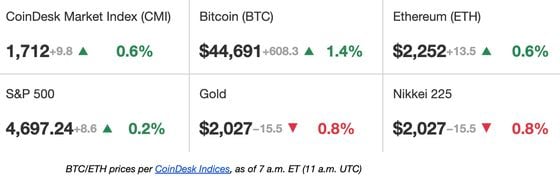

Latest Prices

Top Stories

The wait for the U.S. Securities and Exchange Commission (SEC) to respond to spot bitcoin exchange-traded fund (ETF) applications continues, with a final deadline for at least one application approaching on Wednesday. The SEC must decide whether to approve or reject Ark 21 Shares’ application by Jan. 10, and may approve all of the final applications it is comfortable with by that date. Bitcoin has been consolidating after reaching a 21-month high of almost $46,000 as it awaits clarity on the decision. On Monday, bitcoin gained around 2% to reach $45,000 after dropping to $43,400 over the weekend. If the SEC does not approve spot ETFs this week, LMAX Digital said there could be a significant decline in price but noted, “we also expect any pullbacks to be exceptionally well supported above $30k in 2024.” However, if there is an approval, LMAX said it will translate to an immediate rally to the tune of 10%-15%.

Odds of a spot bitcoin ETF being approved in the U.S. have risen to more than 90%, two influential analysts at Bloomberg said, while crypto market participants at betting platform Polymarket became more pessimistic, trimming the odds to 85% Referring to the likelihood of the SEC rejecting proposals after Friday’s flurry of updated filings, Bloomberg ETF analyst Eric Balchunas said in a Saturday post: “I probably go with 5% at this point. But you gotta leave a little window open for these things.” He previously tipped the odds at 90% in November, saying that updated forms at the time indicated providers were moving in the right direction.

ARK Invest sold a further $20.6 million worth of Coinbase (COIN) shares on Friday across three of its ETFs. Cathie Wood’s investment firm offloaded a total of 133,823 COIN shares, which closed last week at $153.98. ARK Invest has a target of no individual stock surpassing 10% weighting of an ETF’s value. COIN more than doubled in price in the last three months of 2023, heralding consistent sales of the crypto exchange’s shares by ARK. Its largest weighing of Coinbase stock is in its Innovation ETF (ARKK), which holds over $850 million worth of COIN. The latest offload brings its weighting down to 10.04%, suggesting the sales from ARKK could be coming to an end, notwithstanding another pump in Coinbase’s share price.

Chart of the Day

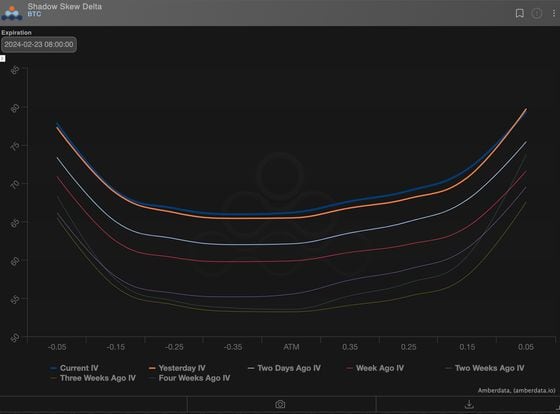

- The chart shows changes in the implied volatility curve derived from bitcoin options expiring on Feb. 23. Implied volatility refers to the market’s expectations for price turbulence over a specific period.

- The curve has steadily shifted higher in recent weeks, a sign of traders preparing for increased price turbulence ahead of the expected U.S. SEC approval of one or more spot ETFs by Jan. 10.

- Source: Amberdata

– Omkar Godbole

Trending Posts

- BlackRock, Other Potential Bitcoin ETF Providers Reveal Fees

- Solana Meme Coins See 80% Price Drop After December Frenzy

- If a Bitcoin ETF Is Approved, Here’s What May Happen

Edited by Sheldon Reback.