How Bitcoin’s $70K hike unveiled something interesting about traders

Bitcoin’s Open Interest sees a significant increase as the price surpasses the $70,000 milestone.

Edited By: Saman Waris

- Open Interest in BTC surged as price reached the $70,000 mark.

- Traders continued to make their bets despite high amount of liquidations.

Bitcoin [BTC] has inspired massive optimism from traders in the crypto space as the price of BTC surged and reached the $70,000 level.

Despite the high volatility, many traders were willing to make bets on where BTC was headed, going forward.

Open Interest on the rise

In the last 24 hours, a billion dollars in Open Interest was added to the Bitcoin markets. More Open Interest generally indicates more leverage in the market, which can amplify price swings in either direction.

Therefore, this development could exacerbate Bitcoin’s well-known volatility.

It is surprising that there was such a sudden uptick observed in terms of Open Interest as BTC’s recent price movements have caused massive liquidations for Bitcoin traders.

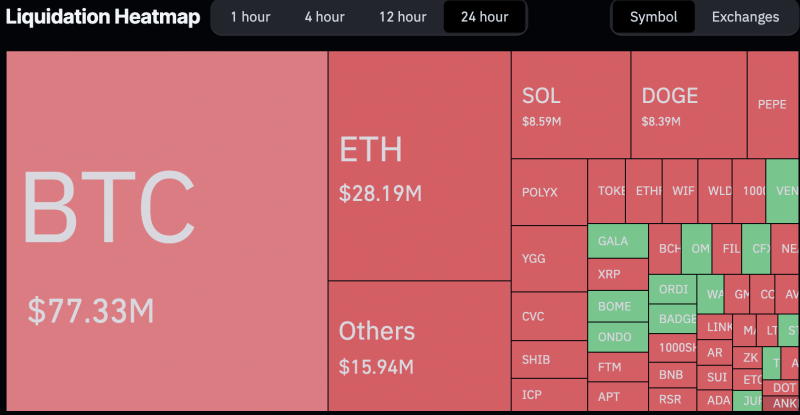

According to data from Coinglass, within the last 24 hours, a staggering 67,109 traders faced liquidation, resulting in total liquidations amounting to $190.70 million.

The largest individual liquidation occurred on Bybit for the BTCUSD pair, with a value of $1.94 million.

Additionally, Coinglass highlighted a significant level of leverage, estimated at approximately $1.18 billion, positioned just above the $73,000 threshold.

Traders turn bullish

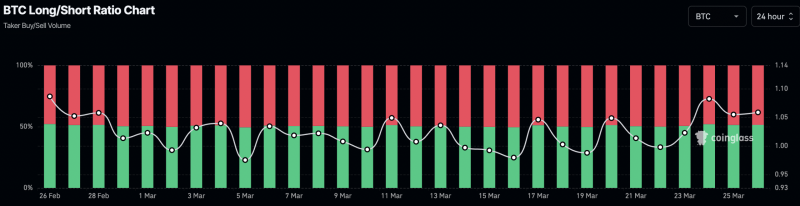

At the time of writing, due to the surge in BTC’s price, the percentage of long positions had grown from 48% to 51%.

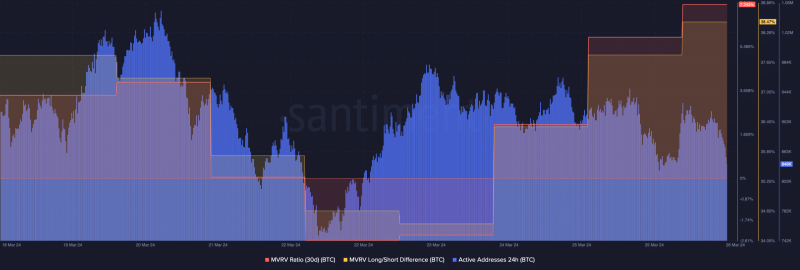

Even though the market sentiment around BTC had turned bullish, there may be some factors that could hinder BTC’s growth. One of them would be the spike in the MVRV ratio.

A surge in the MVRV ratio indicated that most addresses holding BTC were profitable at the time of writing.

As BTC’s price surges, the overall interest in profit-taking would also rise, which could cause price corrections.

Along with the MVRV ratio, the Long/Short difference for BTC also grew. This indicated that older holders of BTC comprised a large percentage of the addresses holding the king coin.

These addresses are less likely to sell their holdings and don’t react hastily to sudden market movements.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s ecosystem will also play a critical role in deciding the price of BTC. According to AMBCrypto’s analysis, the amount of active addresses on the Bitcoin network had declined significantly.

A lack of interest in Bitcoin’s ecosystem may have a negative impact on BTC’s price in the long run.