How Trump Could Change Crypto

Contents

Early Wednesday morning, Donald J. Trump won a second presidential term, completing a stunning political comeback. His victory was also crypto’s.

The industry had championed his candidacy and donated millions to his campaign as well as a host of down-ballot races. Analysts expect a more permissive environment for crypto innovation and regulation as a result.

Unmute

02:31Bitcoin Hits Record High as Donald Trump Wins U.S. Election

24:55Crypto Under a New Administration: Regulatory Outlook From Coinbase's Paul Grewal

24:55Crypto Under a New Administration: Regulatory Outlook From Coinbase's Paul Grewal

02:25DOGE Surges on U.S. Election Day; Bitcoin ETFs Shed $541M and Mt. Gox Moves $2.2B BTC

The election could usher in complete Republican control of the U.S. government, with the White House secured, the Senate flipped and the House likely (though not certain) to remain in the GOP’s hands. After four years of battling the Biden Administration’s, and especially the Securities and Exchange Commission’s, opposition to digital assets, the crypto industry was euphoric at the results.

Here’s what the new political landscape could mean for regulation, assets and major projects, according to CoinDesk analysts and other observers.

Bitcoin to $100K and beyond

Bitcoin is already a beneficiary of yesterday’s election, with prices reaching an all-time-high soon after polls closed. CoinDesk senior analyst James Van Straten expects it to go higher still.

“BTC is still below the [Consumer Price Index] inflation adjusted price which is $77k, so it is still relatively cheap,” Van Straten said. “Google Search traffic for bitcoin on a one-year time frame is also near the lows, which shows we are not near any form of euphoria or greed in the market. As we enter the most bullish period of the year, Q4, we still have two weeks left of the 13-F filings, Nov.14 deadline, to see which institutions have bought the BTC ETFs. In addition, MicroStrategy has announced the biggest at-the-market (ATM) equity offering in capital markets history, which could set the stage for FOMO for other institutions.”

There are caveats, though.

“Trump’s proposed tariffs on China will drive consumer prices higher, bond yields will therefore have to go higher like we are seeing now and interest rates will have to stay elevated and we may even see rate hikes back on the table,” Van Straten cautioned. “This could stunt risk-on assets” – and bitcoin remains in that category.

Good for Tether (USDT), less so for Circle (USDC)

Trump’s victory is also a win for Tether, issuer of the largest stablecoin, USDT, given the company’s relationship with Cantor Fitzgerald. The financial giant manages over $100 billion in U.S. Treasuries for Tether, and Cantor’s CEO, Howard Lutnick, has been a major Trump backer throughout the presidential campaign and is co-chair of the President-Elect’s transition team.

Tether is reportedly under investigation for violations of sanctions and anti-money laundering rules. “While Trump’s election doesn’t necessarily mean the probe will go away, it’s reasonable to expect it won’t be pursued with the same enthusiasm as under the Biden administration,” said CoinDesk markets reporter Tom Carreras.

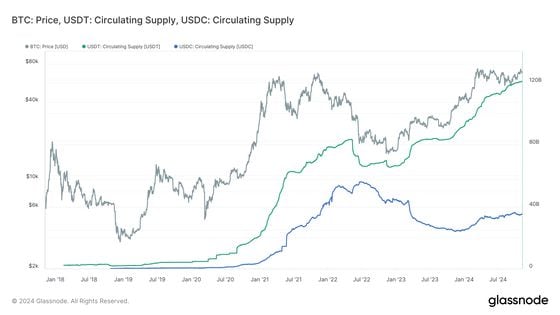

“Tether will likely be given space to keep growing and cement its lead in the stablecoin space,” Carreras said. With a market capitalization of $120 billion, USDT is over three times larger than its nearest competitor, Circle’s USDC. “Trump’s win means the sky’s the limit as far as Tether is concerned. Consequently, it might be even harder now for Circle to catch up to its rival.”

But it’s not all bad news for Circle, Carreras added. The U.S.-based stablecoin issuer “likely now has a more realistic path towards going public.”

Good for solana (SOL), less so for ether (ETH)

Solana (SOL), the third largest cryptocurrency, would also benefit from the election outcome.

“The SEC is poised for a change of leadership, and it would be surprising for the new chairperson to be as adversarial towards crypto as Gary Gensler has been,” Carreras said. One result is that “financial firms will likely file for spot SOL exchange-traded funds (ETFs) and there’s a decent chance that Solana’s uncertain regulatory status will get resolved, allowing financial institutions to interact with the network in a bigger way.”

A more accommodating SEC also means that “Ethereum is unlikely to remain the only smart contract platform to have a U.S. spot ETF for its token (ETH) or to have regulatory certainty around its status as a commodity,” Carreras added. “In other words, the playing field will likely be leveled, and we can expect competition between Ethereum and Solana to only get fiercer.”

More market breadth

So far this year, the rise of crypto prices has mostly been in BTC and a small number of other popular assets. Out of the 20 assets in the CoinDesk 20 index, only six were in the green as of Nov. 1 (Bitcoin Cash, Render, Near, Bitcoin, Ether, Solana).

Now, following the election, Andy Baehr, managing director at CoinDesk Indices, expects a broader rally.

“This time last year, hopes for bitcoin ETFs drove markets and sentiment higher, with bitcoin in the lead,” Baehr said. “This year, the hope is for better regulatory rails that will lead to broader adoption of a wide variety of digital assets. Fast Layer 1 and Layer 2 blockchains, and DeFi stand to gain as the market senses better market structure to promote growth opportunities.”

The CoinDesk 20 Index is up 8% in the past 24 hours (as of 11.30 am ET), led by Uniswap, Solana and Avalanche.

DeFi to benefit, led by Uniswap

Prices for decentralized finance assets have been relatively muted this cycle. But that could soon change.

“In his campaign, Trump promised to make the U.S. a leading hub for cryptocurrency, which might translate into more favorable regulations for DeFi,” said Shaurya Malwa, CoinDesk deputy managing editor for data and tokens.

“His campaign has indicated a move toward reducing the regulatory burden on crypto, potentially making it easier for DeFi platforms to operate within the U.S. This could involve clearer guidelines for token offerings, possibly recognizing certain tokens as commodities rather than securities under SEC oversight.

“Traders are already reacting to Trump’s presidency favorably,” Malwa observed. “Uniswap’s UNI is up 15% in the past 24 hours — quelling concerns of an ongoing SEC lawsuit that alleged the protocol’s makers sold securities in the U.S.”

Goodbye Gensler ?

In his acceptance speech, Trump said “I will govern by a simple motto, promises made, promises kept.” If so, that could mean a series of seismic changes for digital assets, per this reckoner from WU Blockchain:

Most SEC chairs step down following the election of a new president. Universally unpopular in crypto following his aggressive enforcement actions against major crypto companies, Gary Gensler is expected to leave by the end of the year, though appointing his successor will take time, according to reporting from CoinDesk’s Jesse Hamilton. However, Gensler’s five-year term doesn’t expire until Jan. 5, 2026, and his immediate ouster is not a foregone conclusion.

“A second term for President Donald Trump doesn’t mark an automatic end to Gensler’s tenure,” Hamilton wrote recently. “If he decided to make a stand, he could finish out his term as a commissioner and maintain a Democratic majority at the agency for as long as it takes for the new president to make appointments and the Senate to confirm them.”

In May, Trump promised to commute the sentence of Silk Road founder Ross Ulbricht, who is serving a life sentence. In January, he announced his opposition to a “digital dollar” (or central bank digital currency), joining a long list of Republican candidates who have made similar statements.

Edited by Marc Hochstein.