Is Michael Saylor behind Bitcoin’s resurging institutional interest?

MicroStrategy has been at the forefront of Bitcoin institutional demand despite the bearish market conditions. Interestingly, the same company is currently trying to pave the way for the return of institutional liquidity into Bitcoin.

- Bitcoin institutional demand could be on the verge of a comeback after recent findings.

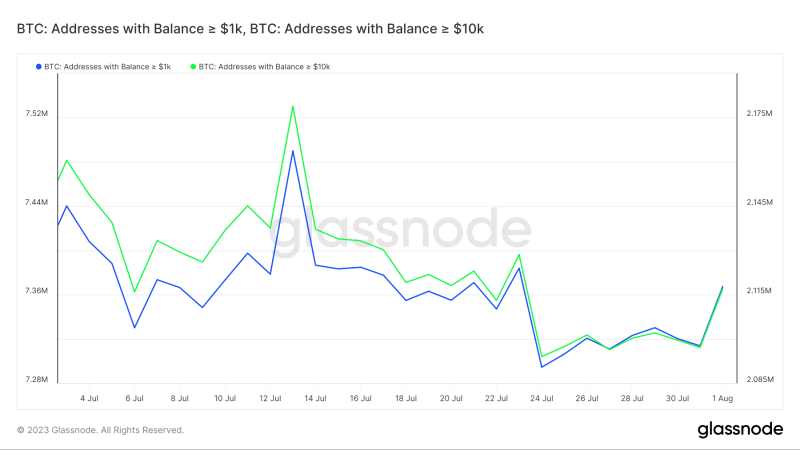

- Whale address analysis revealed a slowdown in sell pressure and some accumulation.

Institutional participation is no doubt one of the biggest drivers of Bitcoin [BTC] adoption. That was at least evident during the 2021 bull run, during which many institutions wanted a piece of the BTC pie.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Institutional demand for Bitcoin diminished during the bear market but has been gradually making a comeback. Its importance is understated considering that it’s right up there with the whales in terms of liquidity.

So, is there a chance for institutional demand to make a strong comeback?

MicroStrategy has been at the forefront of Bitcoin institutional demand despite bearish market conditions. Interestingly, the same company is trying to pave the way for the return of institutional liquidity into the king coin. MicroStrategy recently announced plans to issue shares worth over $750 milllion.

Saylor trying to issue $750 million in MSTR equity to buy even MORE Bitcoin?

This man is an absolute animal. pic.twitter.com/rJ0IhY92pJ

— Will Clemente (@WClementeIII) August 1, 2023

Why is MicroStrategy’s approach good for Bitcoin? Well, it turns out that the crypto investment firm plans to use the proceeds from the sale to buy into Bitcoin. In other words, the offer constitutes a route via which buyers get exposure to the king coin.

Will the move attract more institutional investors back into BTC’s fold? Well, so far, the MicroStrategy share offering constitutes one of the few ways through which institutions in the U.S. can secure Bitcoin exposure. It thus explains the appeal, but does not necessarily mean it will trigger a surge in institutional demand.

It might, however, trigger enough of a confidence boost to trigger more BTC demand. The biggest catalyst for an institutional uptick will likely be the approval of Bitcoin ETFs.

What is holding Bitcoin back?

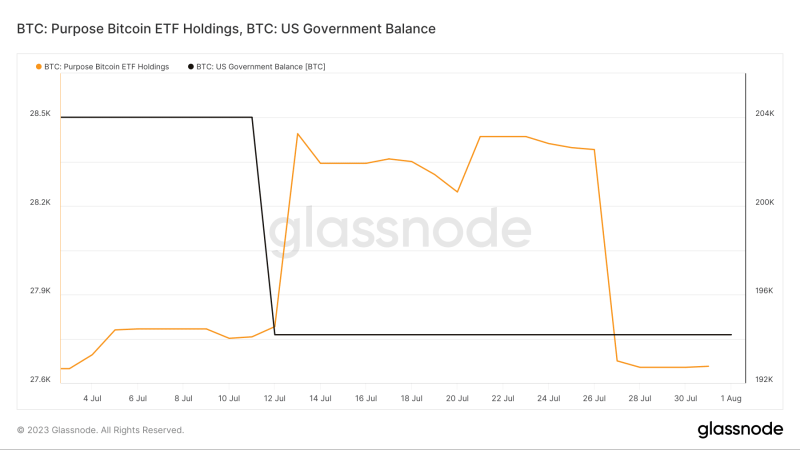

The amount of Bitcoin flowing out of large wallets has been rising of late. Some metrics that confirm this include the Purpose Bitcoin ETF holdings, which indicated that the Bitcoin accumulated through this ETF has been cycled back into the market at press time.

How much are 1,10,100 BTCs worth today?

Similarly, we saw a significant amount of Bitcoin outflows from the U.S. government’s holdings in July. Also worth noting is that the outflows from the U.S. government and the Purpose Bitcoin ETF holdings have leveled out. In other words, Bitcoin’s sell pressure was cooling off.

However, we have seen a bit of an uptick in demand coming from whale addresses. Addresses holding at least 1,000 BTC and even those holding over 10,000 BTC have started adding to the balances. This suggests a higher probability of a bullish outcome.