Solana to $1000? Analyst predicts a 47x hike!

Raoul Pal predicts a potential 47x rise for Solana, forecasting a competitive edge over Ethereum.

Edited By: Ann Maria Shibu

- Raoul Pal sees Solana reaching up to $1,000, outperforming Ethereum.

- Solana’s fundamentals show the asset might be just ready for this run up.

Solana [SOL] has so far demonstrated a significant upswing, marking over a 600% increase since the start of the year. Currently priced at $174, SOL has experienced a 5.1% rise in the last 24 hours and a modest 0.8% uptick over the past week.

This growth reflects a broader trend of increasing investor confidence and market activity within the sector.

Market predictions and analyst insights

Amidst this positive trajectory, notable financial analyst Raoul Pal, the founder and CEO of Real Vision and Global Macro Investor, has shared his insights on the future potential of cryptocurrencies like Bitcoin, Ethereum, and Solana.

Pal identifies these assets as “proven and battle-tested,” suggesting a robust future for these digital currencies in the ever-volatile market.

Raoul Pal’s analysis points towards a bullish future for Solana, predicting a potential increase of up to 47 times from its previous lows, with price targets ranging between $750 and $1,000 per SOL.

This forecast not only underscores Solana’s performance but also its growing relevance as a competitor to Ethereum [ETH]. Pal is similarly optimistic about Ethereum, anticipating it to surpass its all-time highs by 2025.

Pal attributes these potential gains for SOL to a combination of increased usage and technological advancements, particularly highlighting the development of “Fire Dancer,” a scalability solution for Solana.

He draws parallels between the current market dynamics and the 2020 bull run of Ethereum, suggesting a similar trajectory might be on the horizon for Solana. Pal particularly noted:

“If you go back to 2020, Ethereum started basing and then began outperforming from about the summer onwards. It really started picking up towards the end of 2020, and then by 2021, it went ballistic, you know, it went into full banana mode. I think we’ll see something similar.”

Pal also highlighted the role of NFTs in potentially driving Solana’s significant surge, suggesting that most current memecoin investors previously engaged with NFTs, highlighting Solana’s low-cost NFT creation and anticipating new, innovative uses for them in the future.

The analyst noted:

“Somebody’s going to come up with another use for a non-fungible token, whether it’s specific artwork or something culturally relevant that works in the same way as a meme coin, and you can buy them for nothing.”

Fundamentals: Is Solana ready to 47x?

Current market data supports Pal’s optimistic view. Open interest in Solana, an indicator of futures market liquidity, has recently increased by 7.69%, reaching a valuation of $2.62 billion.

This rise in open interest, coupled with a 20% spike in volume, indicates a growing interest from traders, potentially setting the stage for further price increases.

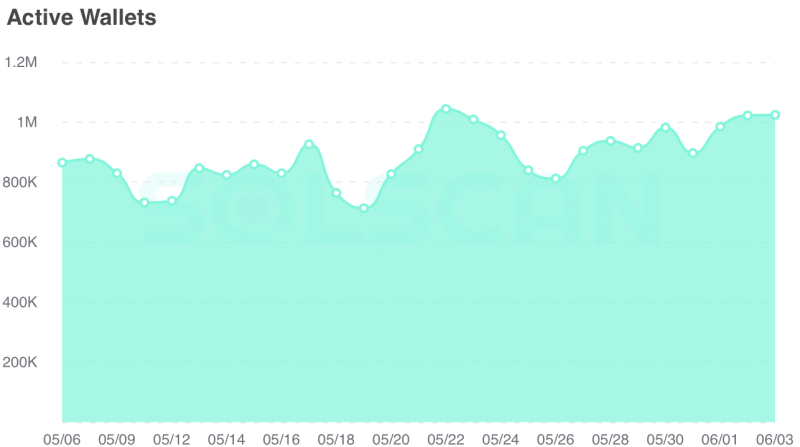

Additionally, the number of active addresses for Solana, according to Solscan, has seen a steady increase, rising from below 800,000 last month to over 1 million today.

This growth in active addresses indicates a rising user engagement and adoption rate, which could signal a strengthening network and potentially higher demand for SOL.

AMBCrypto recently reported that Solana managed to surpass Ethereum in active addresses, although Ethereum continues to lead in transaction volume.

Read Solana (SOL) Price Prediction 2024-25

Meanwhile, volatility metrics from Santiment show a continuous downward trend after a recent uptick in April.

This decrease in price volatility suggests a stabilization of Solana’s market price, which may attract more conservative investors looking for less risky crypto assets.