Solana to $200 or $100? Why SOL has turned volatile today

Solana has started accumulating bullish momentum after testing a key support level.

Edited By: Saman Waris

- Solana was accumulating bullish pressure after rejection at around the $122 support level.

- High circulating supply and active stake indicated strong network engagement.

Solana [SOL] was consolidating in a bullish pennant pattern at press time. The price has declined by around 35% since the 20th of May. However, the $122 support level has rejected the bearish pressure.

Since its rejection, SOL surged by 10% in the last 48 hours. This pattern indicated a continuation of upward building momentum.

As of this writing, CoinMarketCap priced SOL at $136.33, a 1.09% increase over the last 24 hours and a 1.26% increase in the last seven days. Its market capitalization has increased by 1.13% to $63.11.

The MACD indicator showed a fading bearish momentum at press time. This could indicate a short-term price dip before the upward trend resumes.

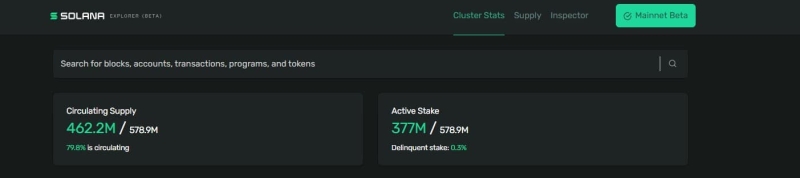

Circulating supply

According to AMBCrypto’s analysis of Explore Solana’s data, Solana has 462.2 million SOL tokens in circulation, out of a total supply of 578.9 million SOL.

This suggested that around 79.8% of total supply were being actively employed in the marketplace. A large circulating supply is a bullish indicator, as it demonstrates active activity from both users and investors.

With 377 million SOL actively staked-around 65.1% of the total supply-there is obvious evidence of high investor trust.

Staking reduces the available supply for trading, which might help to maintain price stability while potentially driving prices higher.

The overdue stake of 0.3% is insignificant, indicating that practically all staked tokens contribute to network security. This emphasizes the stability and dependability of Solana.

Solana: What of investor confidence?

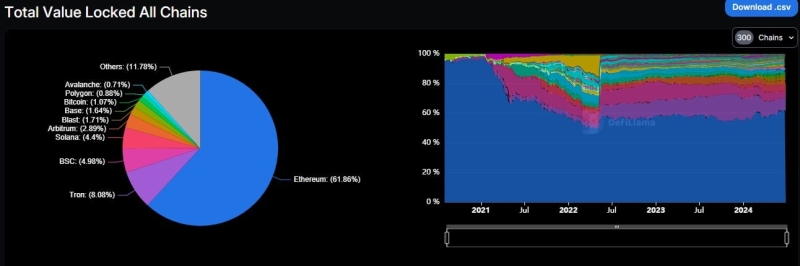

AMBCrypto further analyzed Solana’s Total Volume Locked via DefiLlama. Notably, SOL accounted for 4.4% of the crypto market share. This indicated its expanding popularity and investors’ trust in its DeFi capabilities.

The trend of total volume locked over time showed Solana retaining its position despite market swings, which is a good sign for long-term investors.

Is your portfolio green? Check out the SOL Profit Calculator

Bullish continuation or imminent pullback?

Solana’s accumulating bullish pressure appears to be backed by favorable network fundamentals and market sentiments.

The large percentage of circulating supply, along with significant active staking, indicates strong engagement and confidence in the network. However, the MACD signal points to a possible short-term price pullback.