UK considers blanket ban on crypto investment cold calls

The U.K. Treasury has released a consultation paper to understand the grassroots-level impact of a blanket ban on cold calls related to financial services and products.

As the United Kingdom prepares for a ban on finance-related cold calls, His Majesty’s Treasury has issued a consultation paper, and it is calling for evidence to gauge the full impact on businesses and the costs associated with introducing and implementing the ban.

On May 3, the U.K. government announced an ambitious fraud strategy, which would involve adding 400 new jobs to update its approach to intelligence-led policing. As Cointelegraph previously reported, the National Crime Agency estimates that fraud costs the country approximately 7 billion pounds ($8.7 billion) annually.

“The government will not tolerate this behavior,” said Andrew Griffith, the economic secretary to the Treasury, while criticizing the rising cold calls for financial services and products that often target the most vulnerable members of society.

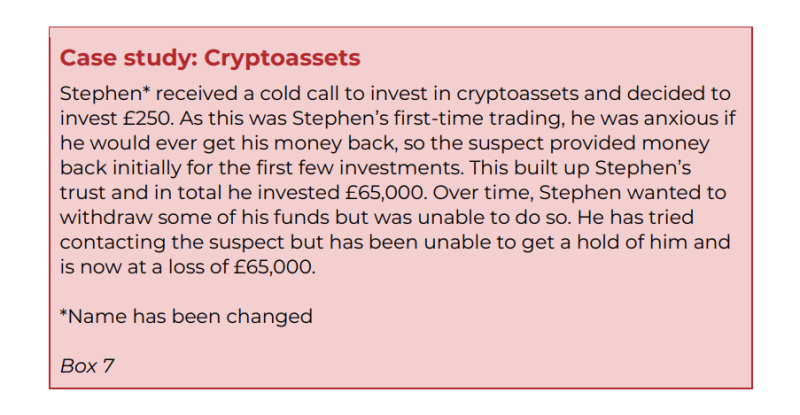

The Treasury highlighted numerous instances where cold calls were responsible for investors’ losses, out of which one involved cryptocurrencies, as shown above. While the U.K. government previously implemented various prohibitions and restrictions on cold calling, scammers often find loopholes in the system to bypass the law.

Intending to impose a blanket ban on financial cold calls, the Treasury put forth 19 questions to stakeholders to ensure maximum impact on scammers and minimum effect on businesses that often rely on cold calling prospects. The consultation closes on Sept. 27, 2023.

The U.K. government recently rejected the appeal to consider and regulate cryptocurrencies as gambling.

“HM Treasury and the FCA [Financial Conduct Authority] will work with the industry to ensure crypto firms are made fully aware of the standards required for approval at the FSMA gateway. Further communications will be provided in due course to ensure standards for approval are clearly available to crypto firms operating in the UK.“

The government response noted that such an approach has the potential to completely counter the globally agreed recommendations from international organizations and standard-setting bodies.