USDT’s presence grows in LATAM, leaves Bitcoin behind

USDT’s growth increases in Brazil as USDT transactions begin to outnumber that of Bitcoin. Despite this, the volume of USDC transactions remains much higher.

- USDT’s popularity in Brazil overtook BTC and other cryptocurrencies.

- However, USDT failed to compete with USDC in terms of volume.

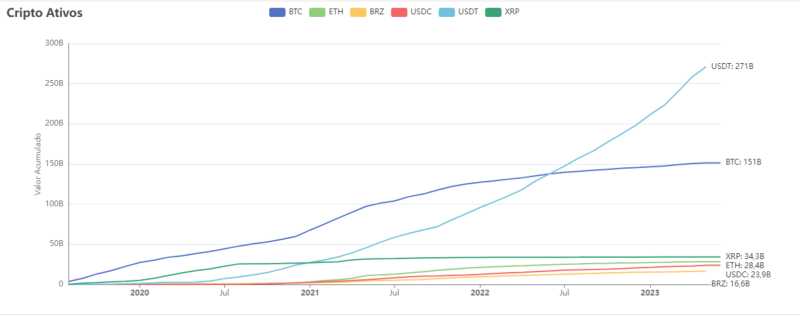

Tether [USDT] has seen a massive spike in its dominance over the past few months. Now, Brazil’s tax department has reported that trading with USDT has been growing in the LATAM region since 2021.

Rising popularity

By mid-October, the total USDT trading in Brazil in 2023 was about $54.5 billion, nearly twice Bitcoin’s [BTC] trading numbers during the same time.

The fact that USDT trading in Brazil was increasing so quickly is important. It showed that more people in Brazil were using this type of cryptocurrency for trading and transactions.

This is majorly a sign of the growing interest in cryptocurrencies in Latin American regions.

Some setbacks

Despite the dominance of USDT, there were some concerns about its link to illicit activities. Organizations such as Hamas and other North Korea-linked groups were reportedly using USDT to transfer funds.

However, recently, Tether took action against illegal activity in Israel and Ukraine by freezing 32 accounts holding $873,118.34. They joined forces with the NBCTF in Israel to fight cryptocurrency-related terrorism and warfare.

Tether was actively working with 31 agencies in 19 places to freeze $835 million in assets. Most of the frozen money was connected to theft, like blockchain and exchange hacks, with a smaller part tied to other crimes.

Tether responded to concerns about cryptocurrency misuse, emphasizing their commitment to compliance and transparency. They stressed the importance of accurate information and welcomed scrutiny based on facts.

They also stated that their mission revolves around responsible and ethical stablecoin use, setting industry standards for integrity and security.

Tether Reinforces Stance Against Crypto’s Terrorist Utilization, Urges Governments to Fact Check Mainstream Media’s Misinterpretation of Data

Read more ⬇️https://t.co/ZMDVdRvuGK

— Tether (@Tether_to) October 26, 2023

Looking at the data

While USDT had the largest market cap, it didn’t grow as much in trading volume. Data from Dune Analytics showed that USDC accounted for 47.9% of all stablecoin trading. USDT came in second place.

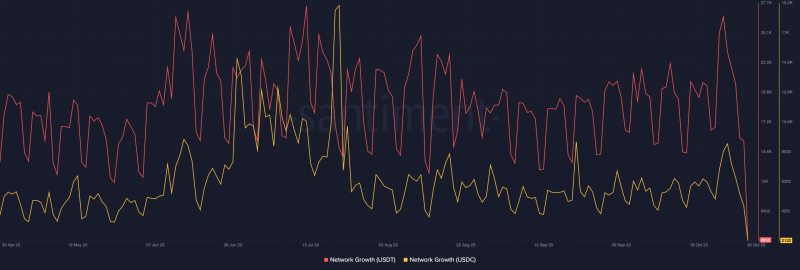

Both stablecoins saw a decline in network growth. This meant fewer new addresses were getting involved with these stablecoins in recent days.