What Is Form 8-K?

Contents

- 1 Definition and Examples of Form 8-K

- 2 Who Uses Form 8-K?

- 3 What To Look for on 8-K Filings

- 3.1 Entry Into or Termination of a Material Definitive Agreement

- 3.2 Bankruptcy or Receivership

- 3.3 Completion of Acquisition or Disposition of Assets

- 3.4 Material Impairments

- 3.5 Unregistered Sales of Equity Securities

- 3.6 Material Modifications to Rights of Security Holders

- 3.7 Amendments to the Registrant’s Code of Ethics or the Waiver of an Ethics Provision

- 3.8 Note

- 3.9 Changes in Registrant’s Certifying Accountant

- 3.10 Changes in Control of Registrant

- 3.11 Amendments to Articles of Incorporation or Bylaws, or Changes to Fiscal Year

- 3.12 Key Takeaways

Form 8-K Explained

Definition

Form 8-K, which is also called a “current report,” must be filed with the U.S. Securities and Exchange Commission (SEC) whenever there is a major event within a company that is of interest to shareholders. In most cases, the form must be filed within four business days of the occurrence of the event. Examples of events that require the filing of Form 8-K include bankruptcy, the acquisition or sale of a business, the departure of a key executive, or a product recall.

Definition and Examples of Form 8-K

Form 8-K provides you as an investor with current information that can help you make informed decisions. A Form 8-K is necessary when there is any company event that you as a shareholder would consider important information in making an investment decision. It is common for companies to file a number of 8-Ks throughout the year, but usually within four days of the event that required Form 8-K.

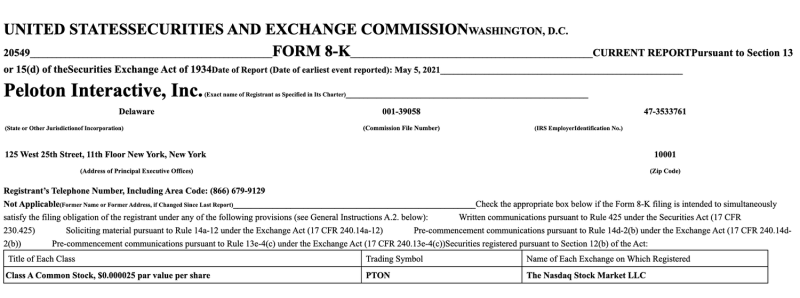

For example, when exercise equipment company Peloton Interactive, Inc. recalled all of its treadmill models due to safety concerns in May 2021, it filed Form 8-K with the SEC explaining its action and what steps consumers could take. Below is a sample from Peloton’s Form 8-K:

Who Uses Form 8-K?

Companies use Form 8-K to file major events with the SEC. Both individual and institutional investors can use Form 8-K to better understand the company they’re investing in.

Note

You can usually access resources that were once only available to professional investors on the company’s website or through the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database. This includes any Form 8-K filed with the SEC, as well as Form 10-K, which is filed annually, or Form 10-Q, which is filed quarterly and includes unaudited financial statements.

What To Look for on 8-K Filings

While investors commonly review 10-Q and 10-K forms for an overview of a company’s financial condition, Form 8-Ks can relate to any number of important but irregular corporate events. Below are several examples of events that could trigger a Form 8-K filing.

Entry Into or Termination of a Material Definitive Agreement

If a company takes out a loan, signs a long-term lease, or if its long-term parts supplier terminates a contract prior to when it was due to expire, that information would be reported on a Form 8-K.

Bankruptcy or Receivership

If a company files bankruptcy or is part of a receivership court filing, it must be reported. Future 8-Ks may report on a company’s plan for reorganization under Chapter 11 or liquidation under Chapter 7 bankruptcy. You might look for information on whether the company’s stock will be canceled or when the company expects to emerge from that bankruptcy.

Completion of Acquisition or Disposition of Assets

Any significant acquisition or sale of assets must be reported. This includes the purchase or sale of a business unit or a merger with another business.

Material Impairments

Writedowns occur when a company significantly lowers its estimate of the value of a specific asset, such as a business or physical plant it acquired. Writedowns often are included in quarterly or annual financial reports instead of a Form 8-K. A Form 8-K writedown may be used when a single event lowers the estimated value of an asset.

Unregistered Sales of Equity Securities

A private sale of securities exceeding 1% of a company’s outstanding shares of that class or 5% for smaller reporting companies should be reported. Public offerings registered with the SEC do not need to be disclosed under this item.

Material Modifications to Rights of Security Holders

Shareholders have rights, such as the ability to vote on important matters. It must be reported if a company changes or severely limits these rights through the issuance of a new class of securities or any other action.

Amendments to the Registrant’s Code of Ethics or the Waiver of an Ethics Provision

You as an investor may be interested in a company’s ethics. Companies must report changes to their code of ethics that apply to high-level executives. Any waivers granted to high-level executives must also be reported. Many investors consider ethics waivers to be a red flag.

Note

A company may choose to disclose changes to its code of ethics on its website instead of filing a Form 8-K.

Changes in Registrant’s Certifying Accountant

It may be concerning if a company dismisses its independent auditor, the auditor resigns, or the auditor declines to stand for reappointment. For this reason, such a change must be disclosed. A company must also disclose whether the departing auditor gave an adverse or qualified opinion on the company’s financial statements, or if the departing auditor had any disagreement over the company’s accounting principles or practices.

Changes in Control of Registrant

A change in the control of the company, including the departure or the election/appointment of directors, board members, or certain officers must be reported. The departure or appointment of a high-level executive (such as a CEO, chief financial officer, or other C-level executive) must be reported. Any changes to compensation of a high-level executive must also be disclosed.

Amendments to Articles of Incorporation or Bylaws, or Changes to Fiscal Year

Disclosure of amendments to articles of incorporation or bylaws is required, as is any change to a company’s fiscal year. A company may disclose such a change in a proxy statement or information statement, in which case, an 8-K is unnecessary.

As you can see, important information in a wide range of areas can be disclosed in a Form 8-K. However, Form 8-Ks are just one source of information that you should review before purchasing shares of stock or while monitoring the company after you own those shares.

Key Takeaways

- Form 8-K must be filed with the SEC when there is any company event that generates information shareholders would consider important information in making investment decisions.

- Form 8-K is often referred to as a “current report” because it typically must be filed within four days of the event.

- There is a wide range of company events that can trigger the filing of Form 8-K, from changes in executive leadership to the purchase or sale of a significant asset to bankruptcy.

- Form 8-K is usually available on a company's website and the SEC's EDGAR database of public filings.

Was this page helpful? Thanks for your feedback! Tell us why! Other Submit Sources The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

-

Investor.gov. "Form 8-K." Accessed May 24, 2021.

-

SEC Edgar Filing Tracker. "Form 8-K Peloton Interactive, Inc." Accessed May 24, 2021.

-

SEC Office of Investor Education and Advocacy. "Investor Bulletin: How to Read an 8-K." Accessed May 24, 2021.