What’s causing Cardano’s development activity to spike?

Cardano’s scalability team launched the Mithril protocol’s mainnet beta. The blockchain’s weekly on-chain performance also looked encouraging.

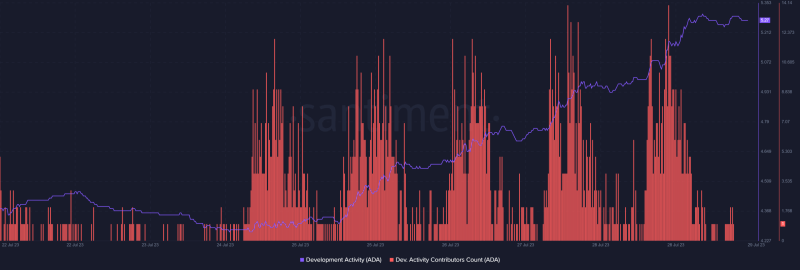

- Cardano’s development activity and dev. activity contributors count increased substantially

- Though on-chain performance was optimistic, ADA’s price did not respond accordingly

Cardano [ADA] has witnessed a massive surge in its development activity over the last few days. The same remained true for its dev. activity contributors’ count.

Input Output Global (IOG) recently published Cardano’s latest edition of its weekly report, which revealed the reason behind this unprecedented growth.

This week’s #Cardano development update is live on #EssentialCardano.

Get the latest on core technology, wallets and services, smart contracts, scaling, governance, #ProjectCatalyst, and Cardano education: https://t.co/xHFUZ2oqGh

— Input Output (@InputOutputHK) July 28, 2023

Cardano steps up its efforts for scalability

Santiment’s chart pointed out that Cardano’s development activity started to shoot up on 25 July 2023, along with its contribution count, which spiked four times after last week’s major update.

The blockchain took a major step last week towards its goal of increasing scalability under the BASHO Era. ADA’s team launched the Mithril protocol’s mainnet beta, which is now open for signer registrations, and its genesis certificate has been created.

While the Mithril team released the new update, the Hydra team updated the specifications to align with recent off-chain protocol changes. They also completed the refactoring of the snapshot emission in preparation for event-sourced protocol logic.

This week, the Plutus tools team worked on improving error reports for Marconi, while the Plutus core team added new built-ins for Keccak-256, which will enhance compatibility with Ethereum.

A look at Cardano’s weekly performance

Apart from the development activity, the weekly report also highlighted the blockchain’s updated stats. For instance, its total number of transactions reached 72.3 million. Cardano’s native tokens exceeded 8 million, while its token policies reached 77,615.

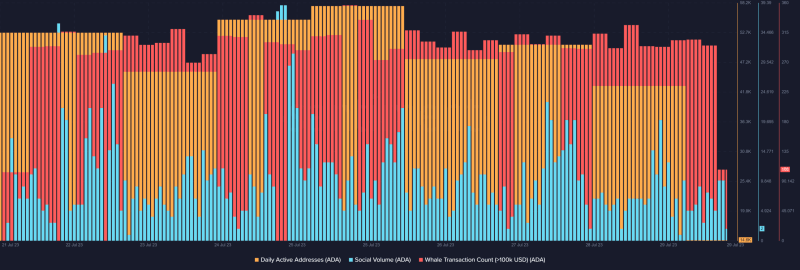

It was interesting to see that ADA’s performance on the metrics front remained positive. Whale transaction counts remained stable last week, reflecting the big players’ interest in trading the token.

Cardano’s daily active addresses were also relatively high at press time. Nonetheless, its social volume declined slightly.

Consequently, ADA’s price action took a backseat. According to CoinMarketCap, ADA was down by 0.8% in the last seven days. At the time of writing, it was trading at $0.3101 with a market capitalization of over $10.8 billion, making it the eighth largest crypto.