Why Bitcoin price’s road to $70K depends on ETFs and more

Bitcoin ETFs have seen a notable increase in interest, with volumes reaching record highs.

Edited By: Saman Waris

- Interest in Bitcoin ETFs had grown as ETF volumes reached new highs.

- Whale interest also surged, however, BTC’s price remained stagnant.

Bitcoin [BTC] has hit a slump over the last few days as the price has remained around the $64,000 level for quite some time.

Institutional interest

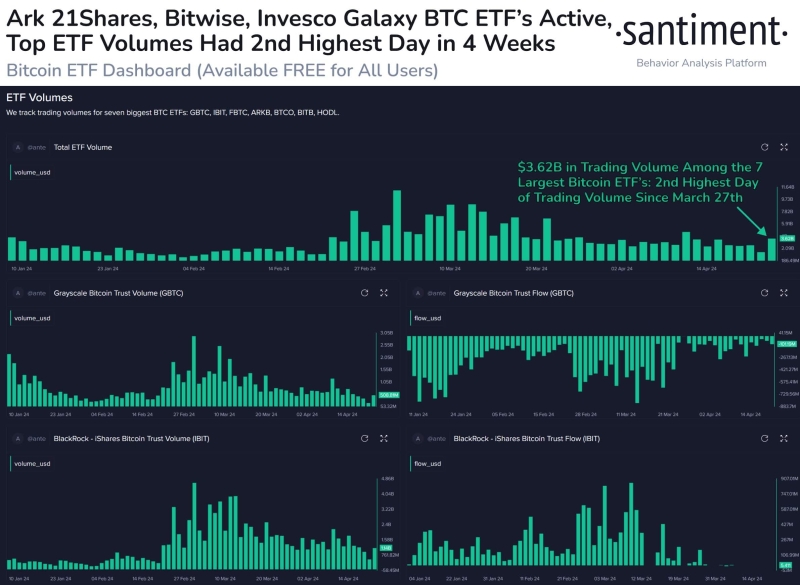

According to Santiment’s data, there’s some for positive movement for BTC in the future. The combined daily trading volume of Bitcoin ETFs recently reached its highest point in four weeks, reaching $3.62 billion.

This surge in activity includes leading Bitcoin ETFs like GBTC, IBIT, FBTC, ARKB, BTCO, and HODL.

This comes amidst a five-week period of unpredictable sideways movement in the broader cryptocurrency market.

In light of this stagnation, the healthy trading activity in Bitcoin ETFs could be considered as a bullish sign.

It suggested that investors remain confident in the long-term potential of Bitcoin, and are using ETFs as a way to gain exposure to the cryptocurrency.

The high trading volume in Bitcoin ETFs highlights their growing popularity as an easier entry point for investors unfamiliar with cryptocurrencies.

This could signal broader adoption of Bitcoin as ETFs remove the hurdles of directly buying and holding the digital asset.

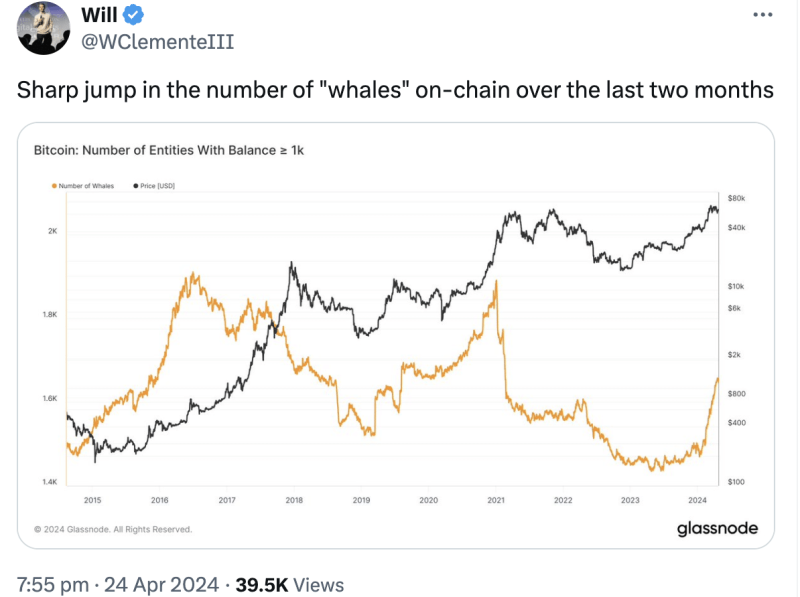

Furthermore, this bullish sentiment is echoed by on-chain data, which reveals a massive spike in the number of whales accumulating Bitcoin over the last two months.

This suggested that not only were new investors entering the space, but established players were also increasing their exposure, potentially anticipating future price appreciation.

How are investors holding up?

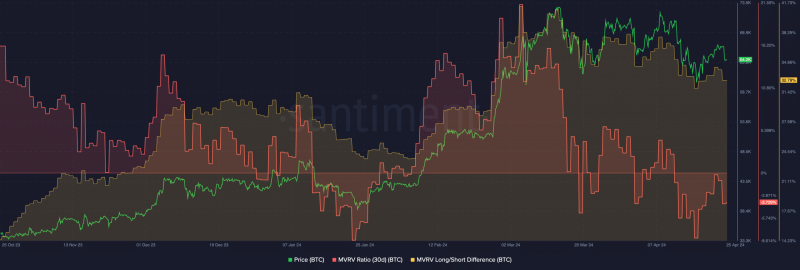

At press time, BTC was trading at $64,334.93 and its price had declined by 3.44% in the last 24 hours. The MVRV ratio had also declined during this period, indicating that most addresses were not profitable.

Additionally, the Long/Short difference had grown despite the declining prices.

A falling Long/Short difference indicated that the number of long-term holders had outnumbered the short-term holders in the last few days.

These holders are less likely to sell their holdings and can help BTC retain its current price levels.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The overall interest in Bitcoin’s ecosystem would also play a great role in the king coin’s growth.

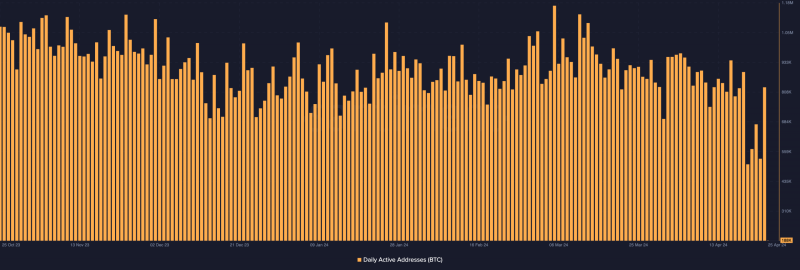

Notably, in the last few days, the number of daily active addresses on the network declined significantly during this period.