Why BNB might be set for a sharp sell-off in October

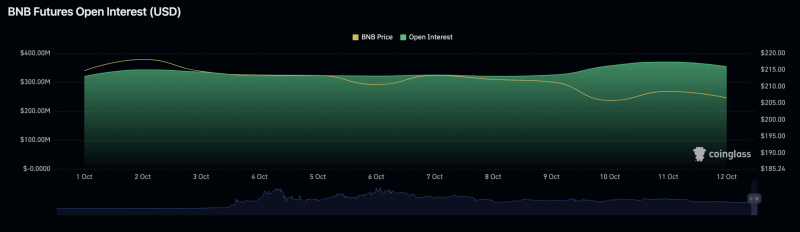

In the last 11 days, BNB’s open interest has climbed by almost 10%. This, according to Santiment, is responsible for the slowed growth in the alt’s price since the month started.

- BNB’s open interest has climbed by double digits in the past 11 days.

- This puts the coin at liquidation risk.

Due to its statistically significant correlation with Bitcoin [BTC], Binance Coin [BNB] has also seen a surge in its open interest since the month began.

Realistic or not, here’s BNB’s market cap in BTC terms

At $353.88 million at press time, BNB’s open interest has climbed by 11% since 1 October, data from Coinglass showed.

In a recent post on X (formerly Twitter), on-chain data firm Santiment noted that the growth in the number of unsettled contracts (futures and options) related to leading assets such as BNB could be a factor in the current struggles of the cryptocurrency market this month.

Regarding BTC, Santiment stated that a surge in the coin’s open interest, especially above $7 billion, is frequently indicative of heightened greed and is often followed by a correction, which pulls down the coin’s value.

The data provider referenced BTC’s deleveraging event of 17 August, which caused the leading asset to record its most significant single-day sell-off of the year. Between 17 and 18 August, BTC’s open interest recorded a 7% decline.

BNB so far this month

At press time, the fourth-ranked crypto asset exchanged hands at $205.80. On a month-to-date, the altcoin’s price has dropped by 4%, according to data from CoinMarketCap.

Price movements assessed on a 24-hour chart revealed that sellers initiated a new bear cycle on 9 October, which has since contributed to the falling decline for the asset.

A look at BNB’s Moving Average Convergence Divergence (MACD) showed an upward cross-over of the signal line with the MACD line on 9 October, and the indicator has since been marked by red histogram bards.

When an asset’s MACD line trips below the signal line, it is interpreted as a bearish signal.

Moreso, at press time, the coin’s negative directional indicator (red) at 22.11 rested above the positive directional indicator (green), which returned a value of 12.74.

Read Binance Coin’s [BNB] Price Prediction 2023-24

When an asset’s Directional Movement Index (DMI) is set up in this manner, it indicates that the sellers have stronger control of the market.

Lastly, BNB’s Relative Strength Index (RSI) and Money Flow Index (MFI) were pegged below their center lines at 38.21 and 35.29, respectively, at press time. This showed that coin distribution outpaced accumulation amongst BNB’s daily traders.