Will Ethereum Drop Back To $900? Here’s What This Analyst Thinks

Following the Terra LUNA network collapse back in 2022, the price of Ethereum followed the general market downtrend. As a result of this, the ETH price had fallen to a new cycle low of $900, before recovering once more. However, now that the altcoin is still deep in the throes of the bear market, questions have arisen once more about the chances of the price returning to its 2022 lows.

Crypto Analyst Says Ethereum Could Drop To $900

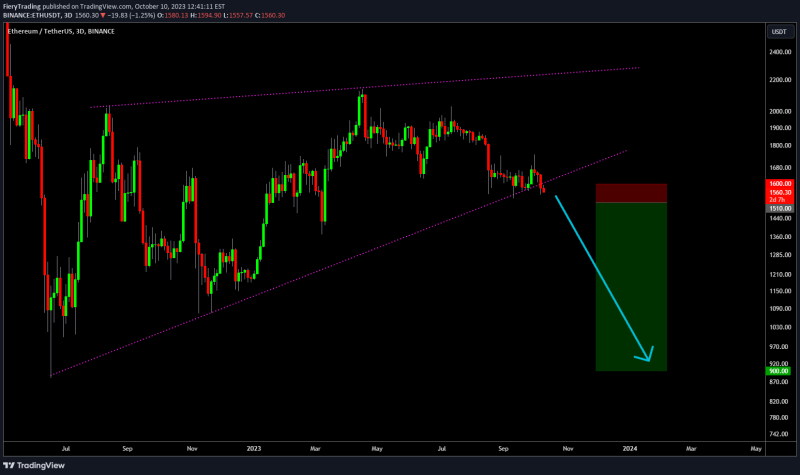

In an analysis posted on TradingView, crypto analyst FieryTrading presents a scenario in which the price of Ethereum could fall back toward its 2022 lows. The analysis in question takes into account the multiple bullish trend lines that the digital asset’s price had fallen through over the last year.

According to FieryTrading, Ethereum had one last remaining bullish line which had emerged on the chart back toward the bottom of the June 2022 sell-offs. However, the digital asset hasn’t been able to hold this trend line and they point out that “it’s well over a year old and must carry some weight.”

Due to this, the crypto analyst believes that the digital asset has entered into a long bearish stretch. As this bear stretch continues, which the analyst expects to be even longer, they see a high possibility of the Ethereum price reaching as low as $900 once more, as shown in the chart below.

Despite being seemingly convinced about ETH’s price decline, the analysis still needs confirmation. Their explanation which is shown in the chart as well asks to wait for the price to break below the $1,510 level for this to take place.

Bearish Going Into The Bitcoin Halving

As the analyst explains, the bearish expectation is not localized to just the Ethereum price alone. It seems to encompass the whole market which the analyst believes has finished out its half bullish stretch and has now entered into the bearish half that often leads up to the halving. As the analyst puts it, this indicates “that it’s the turn of the bears by now.”

This school of thought is not new and is actually backed up by historical data. When looking at the charts of cryptocurrencies such as Bitcoin and Ethereum, it shows that there was a bearish stretch leading up to the Bitcoin halving. After the event, this trend tends to reverse, which then signals the start of the bull market.

In the months leading up to the 2020 halving event, the price of Ethereum saw a sharp decline that put its price in the $120 region before picking back up. So if there is a repeat of this, then FieryTrading’s analysis for ETH could play out.

Follow Best Owie on X (formerly Twitter) for market insights, updates, and the occasional funny tweet… Featured image from Shutterstock, chart from TradingView.com