Bitcoin held in loss hits an all-time low – What now?

Bitcoin’s soaring price excites holders but historic lows in losses signal potential corrections going forward.

Edited By: Ann Maria Shibu

- Historic lows in losses hint at cyclical trends, signaling potential for price corrections.

- Traders remain bullish despite rising implied volatility.

Bitcoin’s [BTC] price has soared massively over the past few days, causing excitement all across the crypto sector. However, beneath the surface, critical indicators suggest that caution might be warranted.

Uncertain waters ahead

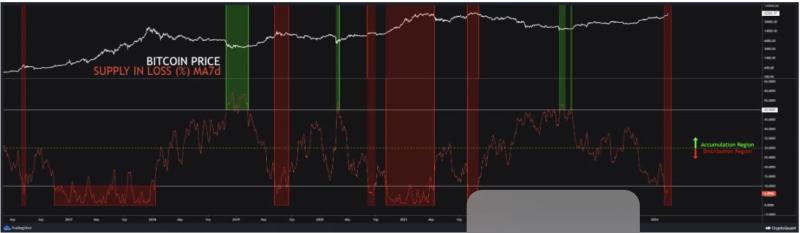

According to a CryptoQuant analyst, the current status of Bitcoin in loss is at historical lows. This metric serves as a valuable indicator to understand the cyclical trends in Bitcoin’s price.

During bullish periods, a substantial portion of the circulating Bitcoin maintains unrealized profits and limited losses. Conversely, in bearish markets, the majority of the circulating supply experiences unrealized losses.

Recognizing this pattern allows market observers to identify potential top or bottom regions in the price, underlining the repetitive nature of market behavior during such events.

The current persistence of this indicator in the extreme region of the distribution is signaling an increased risk of substantial price corrections.

While the surge in Bitcoin’s price has been met with enthusiasm, this data suggests that careful consideration of potential market corrections is essential.

As of the latest data, Bitcoin was trading at $62,826.70, representing a 6.12% increase in the last 24 hours. The total number of holders accumulating Bitcoin had shown growth, indicating continued interest in the cryptocurrency.

However, a closer look at other metrics reveals a more nuanced picture.

Velocity, a measure of how quickly Bitcoin is circulating, had plummeted. This decline in velocity could have implications for the overall dynamics of Bitcoin, potentially affecting its responsiveness to market changes.

What are the traders up to?

Analyzing trader sentiment provides additional insights. The put-to-call ratio, a metric reflecting the ratio of bearish to bullish options contracts, has decreased from 0.52 to 0.47.

This shift suggested that despite the surge in price, traders continued to remain bullish around BTC.

How much are 1,10,100 BTCs worth today?

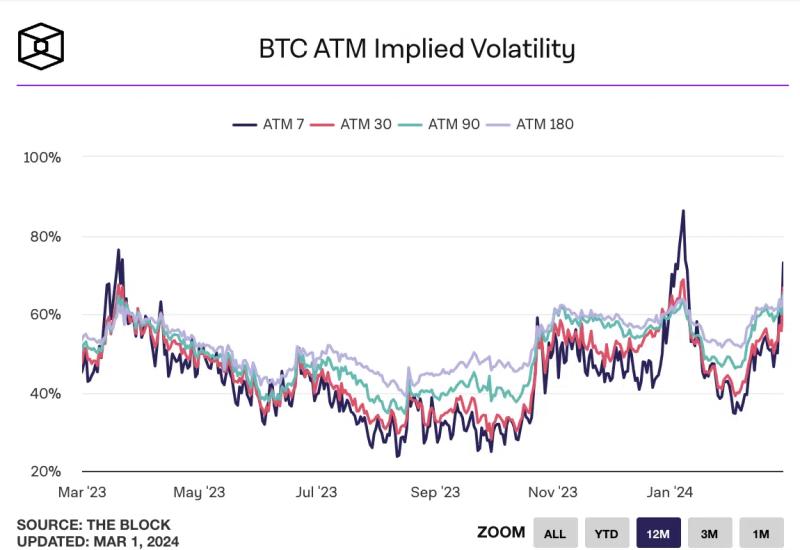

Moreover, implied volatility(IV), a measure of the market’s expectation of future price fluctuations, has witnessed a notable surge in recent days. This increase in volatility could introduce additional uncertainty into Bitcoin’s price movements, impacting both short-term and long-term strategies.

The surge in IV could also reduce bullish sentiment from traders going forward and they may begin to hedge their bets while dealing with BTC.