Ethereum price prediction and strategy for a $4K comeback

991,000 addresses, who accumulated Ethereum when the price was higher, have created a crucial resistance.

Edited By: Saman Waris

- A close above $3,700 could help the price back to $4,000.

- The Pi Cycle Top indicator revealed that the ETH might rally.

Ethereum [ETH] seemed to have become a shadow of its former self after the price collapsed from $3,633 to $3,22o in the last 24 hours.

Despite the decline, AMBCrypto agrees that the value of the altcoin might retest $4,000. However, this prediction might not come cheap or easy.

This is because of the number of addresses that accumulated ETH around $3,700. This has made it a key resistance zone.

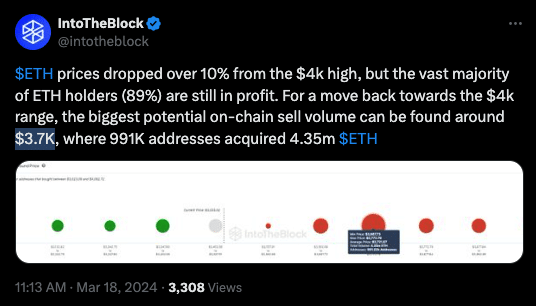

According to IntoTheBlock, ETH’s previous rise above $4,000 placed 89% of its holders in profit.

Who decided what’s next?

However, the recent decline meant that there was a sell wall at $3,700 where 991,000 ETH addresses purchased 4.35 million coins.

With ETH trading below the region, the holders have an opportunity to break even if the price climbs.

If the participants decide to book profits, the altcoin might find it challenging to revisit the psychological $4,000 mark.

On the other hand, if buying pressure outweighs the on-chain sell volume, then ETH might cruise above $3,700.

But whether the cryptocurrency would continue to languish in the red does not depend on the on-chain outlook alone.

Therefore, AMBCrypto gauged the price action from a technical perspective. According to the 4-hour ETH/USD chart, the Exponential Moving Average (EMA) depicted a short-term bearish trend for the altcoin.

At press time, the 20 EMA (blue) crossed below the 50 EMA (yellow). With this trend, the price of the cryptocurrency might drop by another 7.30%. Should this happen, the value could hit $3,112.

A look at the Aroon Indicator also reinforced the bearish bias. As of this writing, the Aroon Down (blue) was 100% while the Aroon Up (orange) was 35.71%. This indicates that sellers were in control of the price action.

ETH is oversold

Furthermore, an assessment of the Supertrend indicated that ETH has not yet flashed a buy signal. But there was an earlier sell signal at $3,780.

Meanwhile, the Relative Strength Index (RSI) was in the oversold region. If the reading continues to decrease, then the chances of a harder bounce might also increase.

In a highly bullish case, ETH might climb to $4,500 when the market turbulence fizzles.

While the short-term outlook looked gloomy for ETH, the Pi Cycle Top indicated otherwise for the mid to long-term.

Historically, the indicator tells when a cryptocurrency is close to the bottom or has hit the market top.

How much are 1,10,100 ETHs worth today?

If the 111-day moving average (MA), in green hits the same region as the 350-day MA (purple), then Ethereum would have hit the top of this cycle.

But that was not the case, as the 111-day MA was lower than its opposite number. Thus, the price of ETH might have a lot of upside potential over the forthcoming months.