Ethereum gas fees take welcome plunge

Contents

The recent drop in Ethereum gas fees brings relief to users. Layer 2 solutions gain prominence, hinting at lower fees and faster transactions. Ethereum’s price faces challenges at $1,900.

- Ethereum’s gas fee was below $2 at press time.

- Ethereum L2s now have a TVL of over $9 billion.

The exorbitant cost of Ethereum [ETH] gas fees has become synonymous with the network’s identity. Yet, a recent development has brought about a welcome decrease in these expenses.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum gas fee decreases

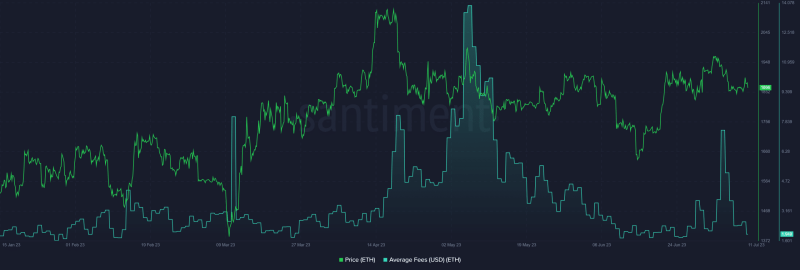

Santiment recently shared an insightful update revealing a notable decrease in gas fees. The accompanying chart vividly displayed the fluctuating nature of these fees, illustrating a surge to over $7 around 5 July, followed by a subsequent decline.

Before this July spike, an even more significant surge occurred in May, with gas fees skyrocketing to nearly $14—an unprecedented high for the network in the current year.

Additionally, in the last 24 hours, most fees were primarily attributed to wrapped ETH (WETH) and native ETH transactions. These two forms of Ethereum tokens accounted for the largest portion of the fees generated on the network during this period.

As of this writing, the gas price had settled around $1.93, offering significant relief to Ethereum users. It’s worth noting that the lowest gas price witnessed this year occurred in February, dipping to approximately $1.7.

A drop in transactions?

According to data provided by DefiLlama, transactions on the Ethereum network have consistently maintained a steady pace, experiencing no noticeable decline since its inception. While occasional spikes have been depicted on the chart, the overall transaction volume was within the normal range.

As of this writing, the network boasted an impressive 1 million transactions.

A possible reason for Ethereum’s gas price drop

The Ethereum network’s congestion and the consequent high gas prices have spurred the development of alternative Layer 2 solutions (L2). These solutions aim to alleviate the strain on the Ethereum mainnet, thereby reducing the fees caused by congestion.

According to data provided by L2 Beats, L2s have gained significant traction regarding user adoption and Total Value Locked (TVL). At the time of writing, the TVL of L2s amounted to an impressive $9.51 billion, with Arbitrum and Optimism leading the market share.

The emergence of additional L2 solutions suggests the potential for lower gas fees on the Ethereum network and faster transaction processing soon.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Trend of ETH

As of this writing, ETH has encountered a setback in its attempt to surpass the $1,900 price threshold. Although it briefly surpassed this level in the previous trading period, it experienced a slight decline in its value during the press time trading period.

The press time trading price hovered around $1,860, reflecting a less than 1% loss. On the Relative Strength Index (RSI), ETH was positioned on the neutral line, signaling a weak bullish trend.