Will Bitcoin’s declining exchange volumes spell trouble?

Exchange inflows start to decline as BTC prices surge. Selling pressure on miners and holders continue to rise as MVRV ratio increases.

- Exchange inflow declined significantly despite BTC’s high prices.

- Miner revenue fell as hashrate increased.

Bitcoin [BTC] has observed quite a rally over the last few weeks, with prices pushing past the $30,000 level. However, the press time’s exchange inflow data suggested that optimistic traders should be wary in the coming weeks.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The state of inflows

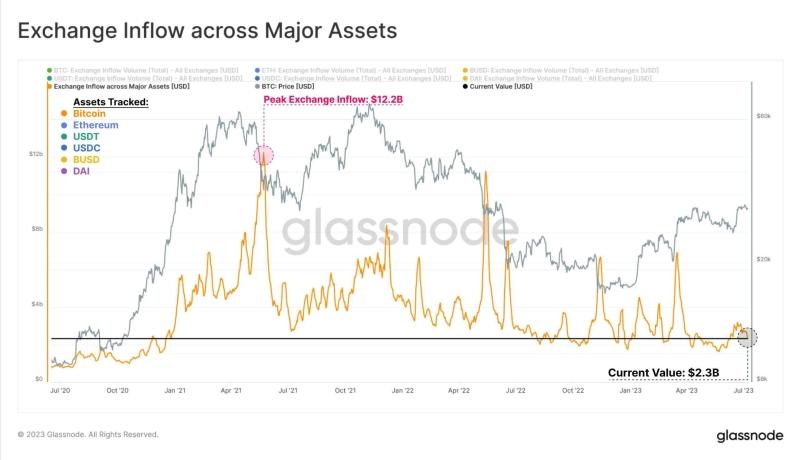

According to Glassnode, Bitcoin’s exchange inflows amounted to $2.3 billion at the time of writing. This observation suggested a widespread contraction in the industry.

Notably, the exchange deposit activity had declined compared to the 2021 bull market, which saw a peak inflow of $12.2B.

The low exchange inflows could negatively impact Bitcoin by reducing liquidity and trading activity. With decreased deposit volumes, there may be limited buying pressure and potential price stagnation.

Lower market participation and decreased activity might lead to decreased price volatility and potentially hinder short-term price growth.

Hash it out

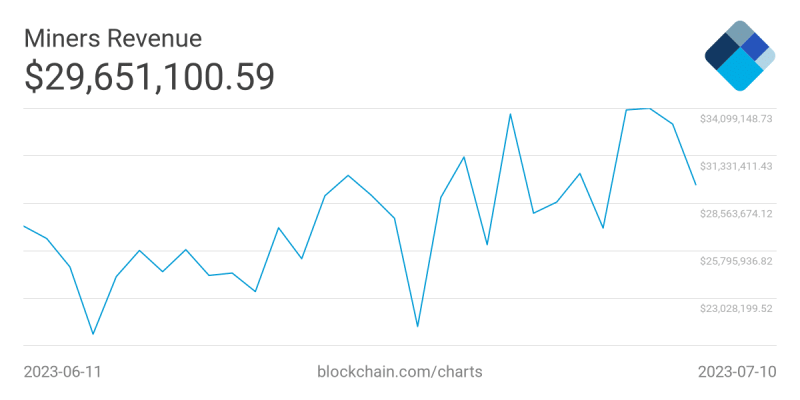

Another factor that could impact Bitcoin negatively would be the selling pressure on miners. Glassnode’s data indicated that Bitcoin’s Hash Rate continued its aggressive expansion and reached an all-time high value of 395 EH/s.

A high hashrate can have negative impacts on Bitcoin miners. It leads to intensified competition among miners, reducing their chances of successfully mining a block and earning rewards. This increased competition also results in lower individual profitability, as mining rewards are shared among a larger number of participants.

Miners face higher operational costs due to the energy consumption associated with maintaining a high hashrate.

The #Bitcoin Hash Rate (7DMA) continue its aggressive expansion, reaching an ATH value of 395 EH/s.

This is equivalent to 395 quintillion guesses every second in an attempt to solve the Block puzzle. pic.twitter.com/SX5bbjt5xV

— glassnode (@glassnode) July 10, 2023

At press time, the daily revenue generated by miners had declined over the last few days.

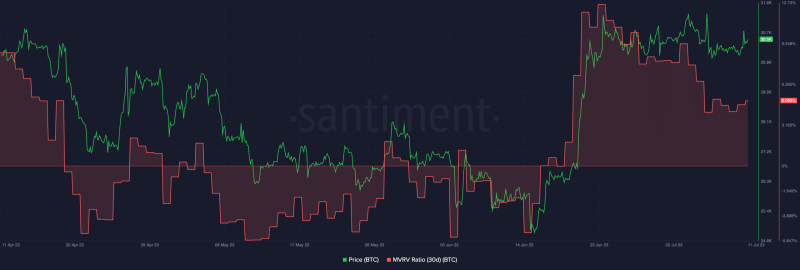

State of BTC

These factors could negatively impact the price of BTC in the future, as declining miner revenues may incentivize miners to sell their holdings.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Addresses also have had a high incentive of selling their holdings. The MVRV ratio for Bitcoin indicated that many addresses holding BTC were very profitable. At press time, BTC was trading at $30,541. The price had seen little movement over the last few days.

The direction in which BTC’s price will go will be determined by whether miners and addresses decide to succumb to the selling pressure.