Ethereum whales have their eyes open, and with good reason too

The lack of large transactions does not necessarily imply disinterest. Instead, it suggests that whales are probably on the lookout for a better accumulation entry.

- Ethereum’s $100k+ transactions hit their lowest level since 2023 began

- Traders are bearish on ETH’s short-term price action

The number of Ethereum [ETH] transactions worth over $100,000 has hit a new low in 2023, according to an update from Santiment. Whenever something of this magnitude occurs, it means that the cohort involved is not excited about the short-term prospect of the cryptocurrency in question.

Watching out for the right season

On the contrary, Santiment, in its 18 September tweet, opined that it is a different case as far as ETH is concerned. According to the on-chain analytics platform, the lack of large transactions does not necessarily imply disinterest. Instead, it suggests that whales are probably patient and on the lookout for a better accumulation entry.

🐳 #Bitcoin continues to trade between $26K-$27K, and #Ethereum at $1.6K to 1.65K. #Crypto's top market caps' $100K+ transaction levels are at their lowest levels of 2023 right now. This is a sign of whales likely waiting, and not necessarily disinterest. https://t.co/FKfhB5X3Yh pic.twitter.com/m9990wqlpM

— Santiment (@santimentfeed) September 18, 2023

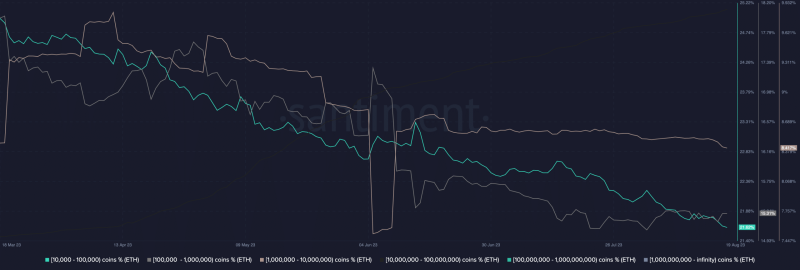

This development was further reinforced by the balance of addresses. At the time of writing, Ethereum addresses holding between 10,000 to 10 million coins have their balance shredded. The fall in the balance means that a lot of whales have cashed in on a part of their holdings.

Also, since the profit-taking, the whales have refrained from accumulating. It was a similar case with the number of whales within the same group. Based on Santiment’s data, the number of addresses holding 10,000 to 10 million ETH has either flatlined or decreased since June.

No relief in sight?

Interestingly, traders also seem to be on the same page as whales as far as ETH’s next direction is concerned. This conclusion was made based on the funding rate at press time. Funding rates are periodic payments made between longs and shorts.

When the funding rate is positive, it means that longs are paying a funding fee to shorts to keep their contracts open. In this case, the average trader sentiment is bullish. However, a negative funding rate means that sentiment is bearish and short positions are dominant in the market.

At the time of writing, ETH’s funding rate had fallen into the negative zone. This means that traders expect ETH to drop below $1,640 in the short term.

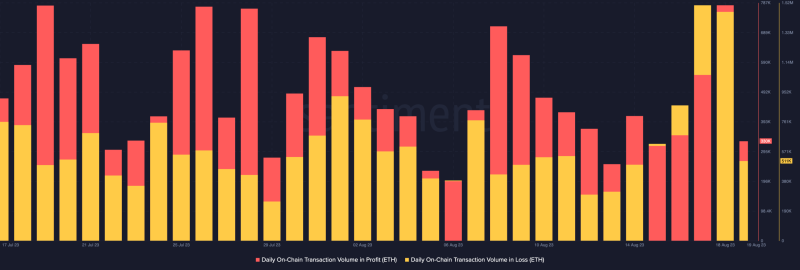

Meanwhile, there’s a chance that the percentage of ETH holders in loss may increase if the altcoin’s value decreases. At press time, the daily on-chain transaction volume in profit was 330,000. On the other hand, the daily on-chain transaction volume in loss was 511,000.

These two metrics show the aggregate amount of coins/tokens across all transactions on the network that moved in profit or loss for a given asset in an interval.

As it stands, short-term holders of ETH may have no other option than to wait for a relief period. And to those who can’t tolerate another decline, they could end up with a loss.