How has BNB responded to Binance’s 25th token burn

On 16 October, leading cryptocurrency exchange Binance removed over 2 million BNB coins from circulation at its quarterly coin burn event.

- On 16 October, Binance removed 2.14 million BNB coins from circulation.

- Demand for BNB has climbed in the past few days.

Binance completed its 25th quarterly Binance Coin (BNB) burn, removing 2.14 million BNB coins from circulation on 16 October. The burned tokens were worth approximately $450 million at the time of the event.

Is your portfolio green? Check the BNB Profit Calculator

Binance’s quarterly coin burns are part of the entity’s commitment to ensure BNB’s deflationary model, thereby preserving its value over time.

The 2.14 million BNB coins destroyed formed 1.38% of the coin’s circulating supply. According to data from CoinMarketCap, BNB’s current circulating supply was over 151 million.

BNB bulls have the upper hand

At press time, BNB traded at $213.01 per coin, having recorded a 3% uptick in price in the last two days.

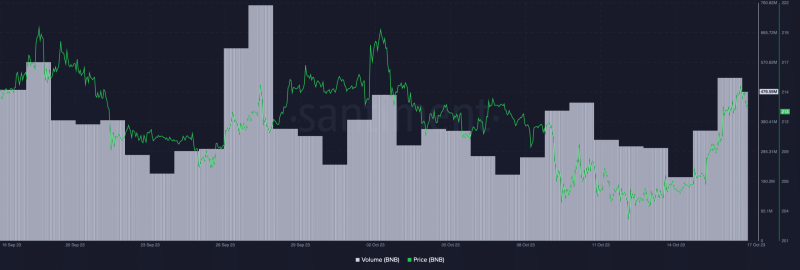

During the intraday trading session on 16 October, the coin’s daily trading rallied to its highest level in the past two weeks, according to data from Santiment.

This confirmed the increased activity around the popular altcoin in the past few days.

According to readings from the coin’s Moving Average Convergence/Divergence (MACD) indicator observed on a daily chart, the coin initiated a new bull cycle on 15 October, hence the price growth.

On that day, BNB’s MACD line crossed above the trend line. When the MACD line crosses above the signal line, it is often considered bullish. It suggests that the asset’s momentum is shifting upward, indicating a potential buying opportunity.

There has also been an uptick in BNB’s accumulation amongst daily traders. The coin’s key momentum indicators were positioned above their respective center lines at press time.

The Relative Strength Index (RSI) was 52.39, while the Money Flow Index (MFI) was 51.55. These values suggested that spot traders preferred buying more BNB than selling.

Moreover, the alt’s Aroon Up Line (orange) was 92.86% at press time. When an asset’s Aroon Up line is close to 100, it indicates that the current uptrend is strong and that the most recent high was reached relatively recently.

Tread with caution

While BNB accumulation has outpaced distribution in the past few days, readings from the coin’s Bollinger Bands indicator suggested a correction might be underway. At press time, BNB’s price approached the upper band of this indicator.

When an asset’s price approaches or touches the upper band of the Bollinger Bands, it often signals that the asset might be overbought. It is taken as a sign of a potential reversal or a slowdown in the upward momentum.

Also, despite the price growth in the past few days, BNB’s Chaikin Money Flow (CMF) continues to return negative values. This has created a bearish divergence, which happens when an asset’s price touches new highs while its CMF declines. It often precedes a decline in the asset’s value.