Bitcoin: Will the muted price action extend?

BTC consolidates losses above 50% Fib level but faces an overhead hurdle at $27.2k. What’s next – a breakout or a range extension?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BTC consolidated recent losses above 50% Fib level ($26.7k).

- Bullish sentiment improved after the 12 October price dip.

Bitcoin’s [BTC] short-term recovery faced a key roadblock at $27k. The king coin’s sharp reversal from $28.2k led to a 5% value loss based on a press time value of $26.8k in the early Asian session on 15 October.

A recent AMBCrypto price analysis of BTC on 13 October showed that an extended value drop to the confluence of range-low/bullish zone at $25k could provide a buying opportunity.

But a spike in short liquidation at a 50% Fib level of $26.7k since 12 October delayed the above projection.

Will Bitcoin sellers drive it lower?

The extended BTC price drop on 11 October left a price imbalance at $26.9k – $27.2k (red). The area has been a crucial short-term hurdle in the past few days.

Besides, the confluence of the price imbalance area with 50-EMA (Exponential Moving Average) and the 61.8% Fib level ($27.1k) could entice late sellers in the area. If so, a crack below 50% Fib level ($26.7k) could set BTC to $26.3k or the range-low area of $25k.

However, a convincing bullish move above $27.2k could confirm a short-term recovery.

Meanwhile, BTC’s Spot market demand improved, as shown by increasing OBV. However, the wavering buying pressure and limited capital inflows demonstrated by RSI and CMF laboring below key thresholds. It could undermine bullish efforts beyond $27.2k in the short term.

Late BTC sellers punished

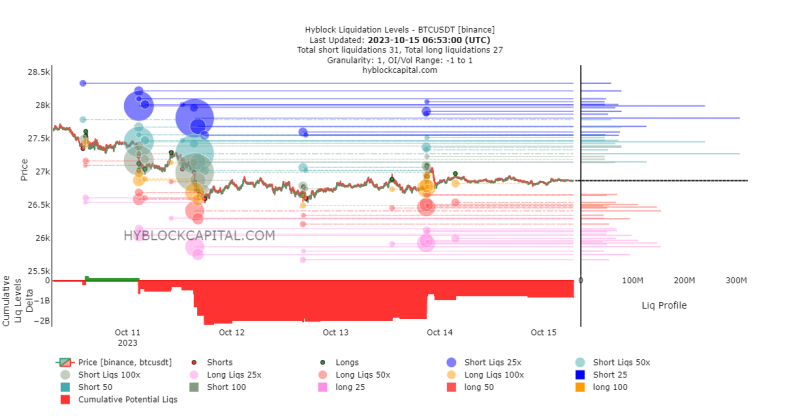

Late sellers were punished, as indicated by the liquidation data from Hyblock Capital. The negative Cumulative Liquidation Levels Delta (CLLD), between 11-15 October, showed more short positions were liquidated over the same period. The negative CLLD also implied a mild bullish bias.

Besides, the liquidity was on the upside, as shown by the liquidation profile (right side of the chart). The key liquidity levels were at $26.9k, $27.2k, $27.8k, and $27.98k (areas marked by larger circles).

However, the $27.2k level was of interest because of its confluence with 50-EMA, 61.8% Fib level and liquidation level. So, BTC’s short-term recovery could face headwinds around $27k.