Tracing the path of declining NFT values – From peak to precipice

Contents

NFTs soared, but now 95% hold no value. Top collections struggle. Will innovation save NFTs or mark their decline?

- 95% of NFTs hold no value, according to recent findings.

- NFT’s weekly volume has declined from its peak of 1 billion to around 70 million.

The decline of Non-Fungible Tokens [NFTs] following their 2021 boom has been a popular topic of discussion, but the true extent of this decline has remained somewhat elusive.

Nevertheless, recent research has shed light on this issue, revealing that a staggering 95% of the NFTs currently in circulation hold no significant value. How does this stark statistic align with the overall volume and the number of traders actively participating in this market?

Over 90% NFTs hold no value

A recent research study conducted by dappGambl, which analyzed a dataset of over 73,000 NFTs, made a striking discovery. Their findings indicated that a staggering 69,795 of these assets possessed a market capitalization of precisely 0 Ethereum [ETH]. This signified that approximately 23 million individuals were holding NFT investments devoid of any value.

Additionally, the research revealed that a mere 21% of these collections had achieved 100% ownership. This also underscored an oversupply of NFTs in the market and a corresponding lack of demand.

These research findings presented a stark contrast to the NFT market’s peak performance. During this time, it boasted billions of dollars in overall value.

NFTs have gained significant attention and popularity in the art world, where digital artists have sold their works for substantial sums. However, they have also been used in gaming, music, virtual real estate, and other digital and creative industries.

Are top NFT collections faring any better?

The research also delved into the top NFT collections, revealing that they were not faring any better. An alarming 18% of these top-tier collections had a floor price of zero, highlighting that a substantial portion of even the most renowned collections struggled to maintain demand.

Additionally, 41% of the leading NFTs were priced modestly between $5 and $100, potentially indicating a perceived lack of value in these digital assets.

Astonishingly, less than 1% of these assets commanded a price tag exceeding $6,000, shedding light on the rarity of high-value assets, even within the elite ranks of NFT collections.

Furthermore, data from Dune Analytics provides insight into the performance of top NFT collections by all-time volume, revealing that only six managed to surpass the remarkable milestone of $1 billion in total volume.

However, an examination of their 30-day trading volume painted a different picture, showing a rather lackluster performance. At the time of this writing, the highest 30-day trading volume observed among these top collections was approximately $9.5 million, while the lowest was around $560,000.

Comparing key metrics during the peak period

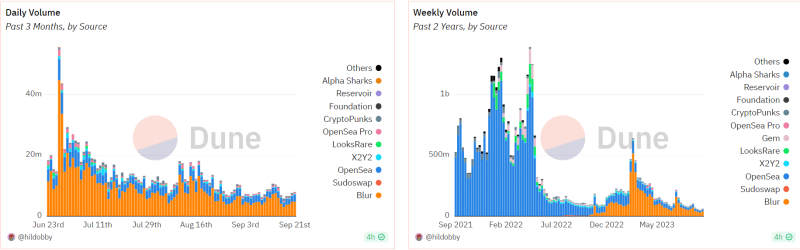

Data from Dune Analytics painted a vivid picture of the NFT market’s trajectory. NFTs experienced a robust beginning and reached their zenith in 2022.

Weekly volume data revealed that even during its peak, the lowest weekly NFT volume exceeded a staggering 490 million, and on several occasions, it crossed the 1 billion mark.

However, as the decline set in, the highest weekly volume observed was approximately 642 million in February 2023. As of this writing, the weekly volume had dwindled to around 70.2 million.

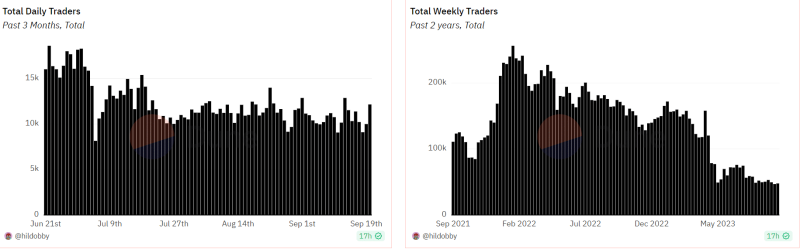

Additionally, the number of weekly trades was another metric that underscored the NFT market’s decline. While this number remained substantial in 2023, it has since decreased significantly.

The average weekly trade volume held steady at around 500,000 until April but had dwindled to approximately 100,000 as of this writing.

Furthermore, the number of traders witnessed a sharp decline, according to the weekly traders’ chart on Dune Analytics. During the NFT craze, the chart showed an average of over 150,000 traders participating.

However, as of this writing, the number of weekly traders had fallen to 47,800, highlighting the significant reduction in market participation.

End of the road for NFTs?

Indeed, we may witness an evolution in the world of NFTs. This evolution may entail a redefinition of their utility and a broadening of their use cases beyond just profile pictures (PFPs).

As technology matures and new applications are explored, they can find themselves at the center of different industries. This could potentially unlock new and exciting possibilities for both creators and collectors alike.