Dogecoin liquidations spike as DOGE hits $0.10: What will happen now?

Questions about Dogecoin’s near-term direction are rising. Here are a few answers that will interest you.

Edited By: Saman Waris

- Liquidation data revealed that long positions bore the brunt, accounting for millions, while short liquidations were under $60,000.

- Dogecoin’s network activity is growing faster than its price, indicating a potential buying opportunity.

Traders with open Dogecoin [DOGE] contracts had to deal with a lot between the 3rd of June and the early hours of the 4th. This was because the total liquidations were over $5 million.

Out of this, long positions accounted for $5.38 million while short liquidations were under $60,000. For context, shorts are trading betting on a price decrease.

Longs, on the other hand, are those predicting a price increase using leverage.

Longs liquidated, but shorts could be next

Liquidations occur when an exchange forcefully closes a trader’s position.

This could be due to high volatility in the market, insufficient margin balance, or an extremely high use of leverage when the market is going in the opposite direction.

In Dogecoin’s case, the price action of the memecoin was the cause. At press time, DOGE changed hands at $0.10 which was a 7.28% decrease in the last 24 hours.

The decline, was, however, in tune with what happened in the broader market.

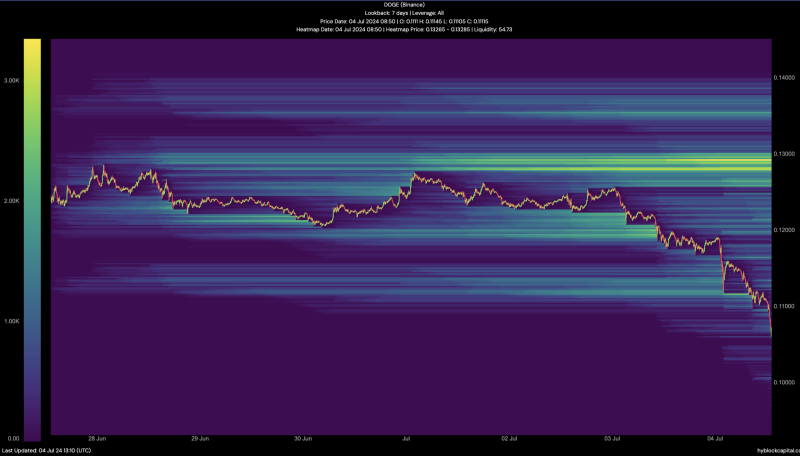

But will the coin price continue to fall, or is respite close? To have an idea of this, AMBCrypto evaluated the liquidation heatmap.

In simple terms, the liquidation heatmap spots price levels where large-scale liquidations might occur.

If there is a high level of liquidity at a region, price might move toward that point. Therefore, liquidation heatmap can gauge directional movement while identifying support and resistance zones.

At press time, using Hyblock data, we observed that there was concentration of liquidity around $0.12. Therefore, if buying pressure increases, the price of DOGE might move in that direction.

A chance to buy has appeared

However, if selling pressure continues to dominate the market, this prediction could be invalidated. Despite the drawdown, the price-DAA divergence showed that it could be time to start accumulating DOGE.

DAA is an acronym for Daily Active Addresses. When put together with the price, it compares the rate of the price increase with the activity on the blockchain. When the price appreciates more than the DAA, it is a sell signal.

In most cases like this, the price-DAA is at an extremely positive ratio. At press time, the metric was -58.32%.

This reading implies that participation on Dogecoin’s network was growing faster than the coin price. If this continues to be the situation, DOGE would have presented a buying opportunity.

Is your portfolio green? Check out the DOGE Profit Calculator

Going forward, the price of the coin might consolidate around the $0.10 region. However, there is a chance that market participants might start accumulating the coin in the weeks to come.

If this happens, DOGE might begin a slow movement that takes it toward $0.12 as stated earlier.