Cardano set to rally another 8% soon, here’s why

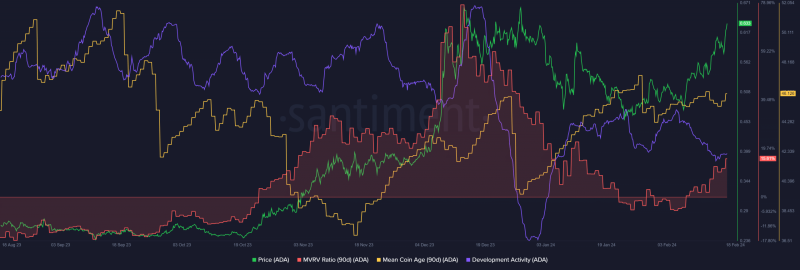

ADA’s MVRV ratio climbs steadily higher, showing that holders are confident and in profit.

Edited By: Saman Waris

- Cardano flipped a technically significant resistance zone at $0.56 to support.

- A rally to $0.7 was likely, but further gains could be impeded.

Cardano [ADA] has exhibited a bullish market structure since the 8th of February, when prices convincingly breached the $0.524 resistance level.

The buyers have maintained that momentum and forced gains worth another 10% in the past ten days.

Alongside the Polkadot [DOT] network, Cardano has displayed consistently high developmental activity.

A recent AMBCrypto explored how Cardano surpassed the Polkadot network in this metric, which should instill long-term investors with confidence.

The FVG and OB breach at $0.56 gave the buyers confidence

Marked in cyan, the $0.558-$0.578 region represented a bearish order block on the 12-hour chart. A fair value gap (white box) at $0.554-$0.57 coincided with it.

Together, they represented a stern zone of resistance.

However, the bulls managed to break this resistance zone and drive prices higher. On top of that, the OBV, which had been trending downward since January, broke out of its slump.

This influx of demand was one of the reasons that ADA was able to burst past its resistance.

To the north, the $0.69 area was a high that ADA established in December 2023.

It is thus likely that the $0.68-$0.7 zone would be filled with sell orders, meaning that the buyers could have a hard time pushing above this resistance zone.

Metrics highlighted the bullish sentiment

The MVRV ratio had fallen below zero in early February. Since then, it has climbed higher steadily to show that holders were confident and in profit. Sentiment also favored the buyers.

The rise in the mean coin age since January also signaled a strong HODL mentality.

Is your portfolio green? Check out the ADA Profit Calculator

The development activity has trended downward over the past two weeks.

It was also notably lower than it had been in November 2023, but as covered earlier, the network was ranked second for its 30-day dev activity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.