Can Bitcoin rise above $35K?

Bitcoin’s key metric reveals that its market capitalization has neared an overvalued level. Does this indicate a price correction?

- BTC’s price moved marginally over the last 24 hours.

- Most market indicators and metrics looked bearish.

Bitcoin’s [BTC] price has been consolidated near the $35,000 mark for quite some time now. Though this was a positive signal, it also meant a halt to the king of crypto’s bull rally. But some datasets suggest that dark days might be ahead for BTC.

Is Bitcoin actually overvalued?

Bitcoin investors have finally rejoiced at the fact that the coin has managed to remain above a key level. However, its gaining spree has somewhat stopped as its price has not been moving up as fast as it was a few weeks ago.

According to CoinMarketCap, BTC was only up by 4% in the last 24 hours. At the time of writing, BTC was trading at $35,154.78 with a market capitalization of over $686 billion.

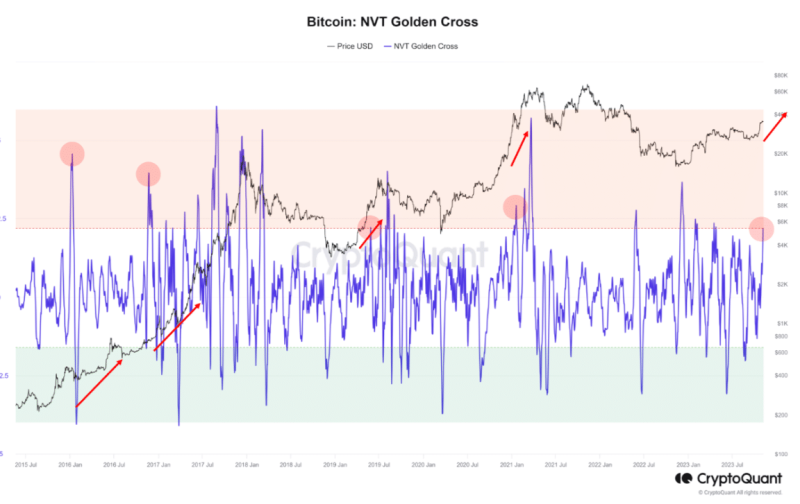

While BTC’s price remained near the $35,000 mark, a key indicator turned bearish. MAC_D, an author and analyst at CryptoQuant, recently pointed out in an analysis that BTC’s Network Value to Transactions (NVT) signal reached an apparently overvalued level.

To be precise, the press time value of this indicator was 2.19.

For the uninitiated, the NVT ratio describes the relationship between market cap and transfer volume. The metric is calculated by dividing the market capitalization of a coin by the total amount of BTC on-chain transaction volume. However, there was an interesting catch.

MAC_D mentioned in the analysis that such episodes have been a common occurrence in past recovery phases, for BTC to rise as the market capitalization increases. This has frequently resulted in further price gains and a transition to a bull market.

Though the NVT signal has acted differently in the past, let’s check other metrics to see if a price correction is incoming.

Bitcoin might witness a correction

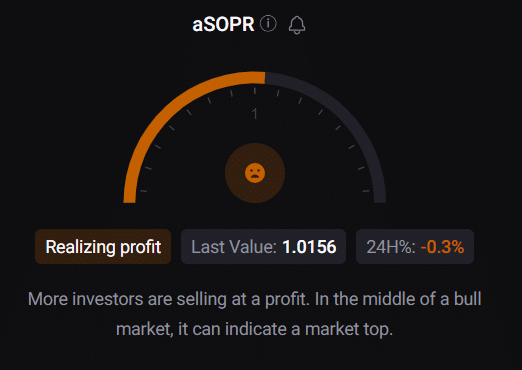

CryptoQuant’s data revealed that BTC’s exchange reserve was increasing, meaning that selling pressure on the coin was high at press time. Its aSORP was also red. This clearly meant that investors were selling their holdings at a profit, which could be interpreted as a market top in a bull market.

Not only these metrics, but a few market indicators also looked bearish on the king of cryptos. For example, the MACD displayed a bearish crossover. BTC’s Relative Strength Index (RSI) was in the overbought zone.

Additionally, its Money Flow Index (MFI) registered a decline and was headed towards the neutral mark, increasing the chances of a price correction.