Ethereum regains its groove? All about ETH’s 7% uptick in 24 hours

After a plummet under $3k, Ethereum’s price gained bullish momentum – $4k this week?

Edited By: Saman Waris

- ETH was up by more than 7% in the last 24 hours.

- Metrics and indicators looked bullish on the token.

Ethereum’s [ETH] massive price decline seemed to have come to an end as the king of altcoin’s price increased in the last 24 hours.

In fact, as per AMBCrypto’s analysis, things might turn bullish for the king of altcoins, which might allow ETH to recapture its lost value.

Ethereum is buckling up

The crypto market witnessed a crash on the 12th of April, which had a major impact on ETH’s price.

The downtrend pushed the king of altcoins’ price under $3k, which raised alarms and caused panic among investors.

However, the last few hours witnessed a change in market trend as most cryptos daily charts turned green.

Sjuul, founder of AltCryptoGems and a popular crypto analyst, recently posted a tweet revealing that if ETH manages to go above $3,050, a bull run might begin.

The good news was that ETH managed to move above that level. According to CoinMarketCap, ETH was up by more than 7% in the last 24 hours.

At press time, it was trading at $3,257.33 with a market capitalization of over $391 billion.

To see whether this is the beginning of a full-fledged recovery, AMBCrypto checked Ethereum’s on-chain metrics.

Our analysis of CryptoQuant’s data revealed that its exchange reserve was dropping, signifying a drop in selling pressure.

Upon further analysis, we found quite a few other bullish metrics. For example, the token’s active addresses increased by 12%. Meanwhile, its transaction count also surged by nearly 10% compared to yesterday.

Additionally, ETH’s Funding Rate was green. This meant that long-position traders were dominant and were willing to pay short-position traders.

What are the next possible targets?

AMBCrypto then analyzed Ethereum’s daily chart to see the possibility of the token continuing its price uptick. ETH’s Relative Strength Index (RSI) registered a sharp uptick on the 15th of April.

The Money Flow Index (MFI) also followed a similar trend, hinting at a continued price increase. ETH’s price rebounded from the lower limit of the Bollinger Bands, further suggesting that the bull rally might continue.

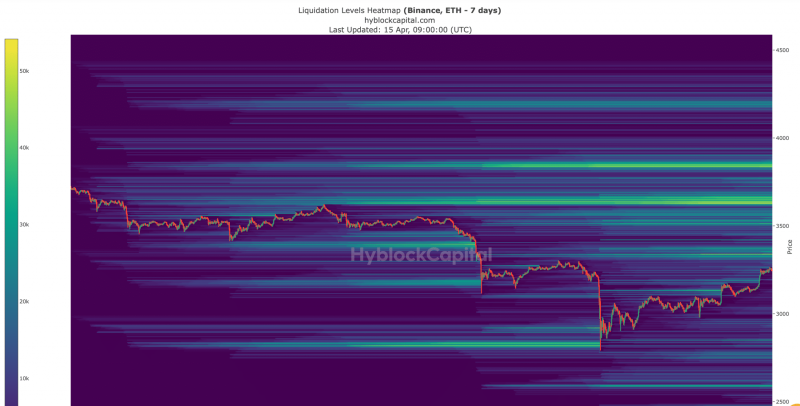

Our look at Hyblock Capital’s data pointed out quite a few levels that ETH might reach this week if the bull rally actually sustains. The first target for ETH might be $3.34k, as liquidation would rise at that level.

If a successful breakout happens above that, then ETH might as well touch $3.6k or even $3.8k in the following days.