Influencer-Investors Get Perks to Pitch Tokens: Inside Crypto’s ‘KOL’ Economy

Contents

10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

- Members of crypto’s influencer class are writing checks for countless startups and then promoting them on social media.

- In return, these so-called key opinion leaders get discounted valuations and options to sell sooner than other early investors – sometimes right when the token launches.

- “KOL rounds” are an increasingly popular way for founders to market their projects without spending anything out of pocket, unlike the old model of paid promotion.

- KOL arrangements aren’t always disclosed to the investing public, several insiders said.

Unmute

00:59Can Blockchain Impact the History of Art?

00:57Is Meme Coin Demand Stronger Than Ever?

02:20Binance Fired Investigator Who Uncovered Client Market Manipulation; 'Boden' Memecoin Surges

20:00What Happens if ETH Is Deemed a Security?

Crypto founders have long relied on Silicon Valley-style investors to fund their risky ideas. But in the last few months, venture capitalists and angel investors have given way to a new breed of influencer-turned-investor: the KOL.

Key Opinion Leaders flood the social media feeds of global crypto users with “alpha” about which protocols to watch and invest in. They can be as pseudonymous as a cartoon penguin or as recognizable as a YouTube personality.

A CoinDesk review of KOL fundraising found a budding economy of influencers who write checks for crypto startups and then promote them to thousands of retail traders on YouTube and X (formerly Twitter). Projects are betting KOLs will help attract users and, critically, eager buyers before they issue their tokens.

“The further they are gonna shill their bags, the further the token might go, which is super-good for the project and super-good for price action,” said Vlad Svitanko, the CEO of marketing firm Cryptorsy, which helps organize KOL rounds.

KOL rounds are a twist on the paid shills of earlier crypto cycles, those high-flying influencers like Ben Armstrong (aka BitBoy Crypto) who charged tens of thousands of dollars to promote tokens to massive online audiences. Instead of billing projects for their services, KOLs now put money in them – albeit on very generous terms. Those terms include discounted valuations and options to sell tokens sooner than other private investors are allowed to.

Crypto’s upper class is acutely aware of how these “KOL rounds” operate, CoinDesk found in over two dozen interviews with founders, developers, investors and other insiders who insisted on anonymity to discuss fundraising from influencers.

It’s less clear how well retail investors (the ones being influenced) understand the KOLs’ financial relationship with the projects they’re boosting. Many KOLs don’t disclose their paid deals. Failure to do so could violate U.S. consumer-protection laws, according to a lawyer familiar with these arrangements.

“When influencers fail to disclose such arrangements, they mislead their audience, many of whom rely on these endorsements to make financial decisions,” said Ariel Givner, an attorney who runs a crypto law practice near Philadelphia. “This lack of transparency undermines the trust that is essential in digital commerce and can lead to significant financial losses for unsuspecting followers.”

KOLs’ prominence is only poised to grow as the multi-billion-dollar “creator economy” reshapes online life. Crypto may be supercharging the trend.

“It’s a massive thing. It’s circumventing not only VCs, it’s also circumventing marketing,” said one well-connected person who works with KOLs. “People are going to say they don’t even need marketing – they get capital from distribution.”

Humanity Protocol

One startup that turned to KOLs recently is Humanity Protocol, a competitor to Sam Altman’s billion-dollar digital identity project Worldcoin.

Far-smaller Humanity Protocol raised $1.5 million from a combination of angel investors and KOLs in early March, according to an investor presentation. A document titled “Humanity Protocol’s Alignment form for KOLs” assigned influencers six months of social media homework: “like” and comment on three tweets a week, write three tweet threads about Humanity Protocol, join at least one of Humanity Protocol’s Twitter Spaces a month, among other requirements.

The project gave content-specialist influencers granular missions. Trader KOLs should publicly buy Humanity Protocol’s yet-to-be-announced tokens “after the launch to demonstrate commitment,” one document said. It directed YouTuber KOLs to create two “speculative videos about Humanity Protocol being a main Worldcoin competitor and about the Airdrop.”

“We’re tracking all activities and will void the SAFT and refund KOLs who aren’t keen on supporting the project,” the Humanity Protocol document said. SAFTs (simple agreements for future tokens) are the contracts through which crypto startups pledge their potentially valuable tokens to backers, including VCs, angels and KOLs.

Flashback to 2017 | SAFT Arrives: ‘Simple’ Investor Agreement Aims to Remove ICO Complexities

A spokesperson for Humanity Protocol declined to comment.

In one recent video, a presenter for the YouTube channel Altcoin Buzz, which has 419,000 subscribers, touted Humanity Protocol’s “huge competitive advantage” over Worldcoin. Altcoin Buzz employee Shitij Gupta shared the video in a private Telegram channel maintained by Humanity Protocol (dubbed “Humanity Protocol – KOLs”), two eyewitnesses said. KOLs are asked to join the channel after filling out an “alignment” form that CoinDesk reviewed.

Contacted by CoinDesk, Gupta said “Altcoin Buzz has not invested in Humanity,” and that he is in the private KOL channel on Telegram “because we want to get information on the project.”

He did not rule out receiving future compensation (“not yet,” he said, when asked about pay) but said Altcoin Buzz would disclose any “sponsorship.”

Crypto companies often give their VCs and angels equity. KOLs seldom get shares in the company. Instead they get tokens: a stake in the decentralized crypto network that the company is building.

Tokens are where the money is in crypto, anyway. Humanity Protocol wrote in its undated KOL document that its rival Worldcoin had a fully-diluted valuation (the sum total of all its WLD tokens) of $80 billion.

Tokens are also easier to sell than equity. Among crypto startups’ private investors, few have a faster path to selling them than KOLs.

Evolution of KOLs

Influencers began monetizing their followings BitBoy-style years ago. The old pay-to-play model still hits.

“KOLs can charge tens of thousands just for one tweet,” a general partner at one VC said. “They are probably one of the most lucrative businesses” in crypto.

The startup world is a haven of “angels”: deep-pocketed (often well-known) investors who write small checks for startups, lending cash and credibility. They’re influencers – KOLs in their own right. Sometime last year angels and KOLs began to converge. Then the convergence accelerated.

By 2024, it wasn’t just headliners joining KOL rounds but “anyone with a pulse” who had many thousands of followers, quipped one high-ranking employee at a crypto startup.

“The funny fact is that 75% of more-or-less well-known TGEs that took place since the beginning of the year had KOL rounds,” estimated Stacy Muur, an influencer with 46,000 followers who, over text messages, said she does not engage in these deals. (TGEs are token generation events).

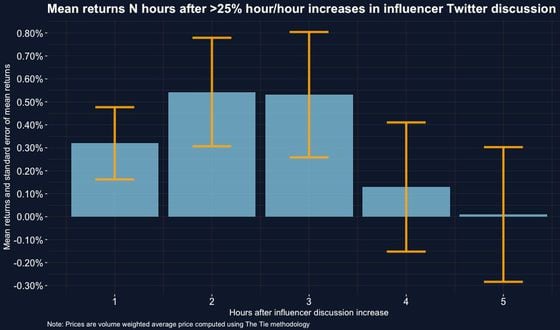

According to research conducted by market intelligence firm The Tie, which tracks token prices as well as KOL activity on social media, influencers regularly move the crypto markets.

“They definitely have an impact,” CEO Joshua Frank said of KOLs, adding they likely have outsize influence on cryptos with smaller market caps.

‘A quick buck’

KOL rounds have essentially become a vehicle for projects to fund their marketing without having to pay for anything out of pocket. Instead, they bring dozens of influencers to their cap table.

“I think it’s better kuz then the influencers have real skin in the game, they buy their share,” one prolific investor with tens of thousands of followers wrote in a text message.

Their incentive alignment isn’t always built to last. Participants in KOL rounds often get a good chunk of their tokens unlocked on token launch day, meaning they can sell as soon as the token debuts.

“Right now the trend is that nobody accepts more vesting than 12 months,” said Matas Čepulis, an executive at the car-focused metaverse project OBS World and associate at the marketing firm KOL HQ. “Everybody wants to make a quick buck.”

An AI-focused crypto project called Creator.Bid is letting its KOLs access as much as 23% of their BID token allocation on May 15, when the public gets its airdrop, according to terms circulating among investors. A second called Veggies Gotchi is giving KOLs the same number of tokens as its selling to the community, according to its documents. Neither project commented.

Citizend, a token launch platform that’s about to hold a community token sale, is giving KOLs a less favorable unlock and vesting period than retail buyers, said Julian Leitloff, an advisor to the project. In a text message he said Citizend requires its KOLs to promote the project but leaves disclosures up to them.

“That is their obligation and nothing we enforce contractually,” he said.

‘Heavy loss for retail’

KOL arrangements are “a win for protocols, a win for KOLs, but a heavy loss for retail,” said Muur, the influencer who said she doesn’t take these deals. “These deals are not properly disclosed in most cases, so the community doesn’t know about KOL rounds and its vesting terms,” she lamented, expressing a sentiment echoed by other insiders.

Because most crypto projects don’t consider their tokens to be securities, they don’t follow the transparency rules that apply to promoters in stock markets, people in the KOL industry said.

U.S. securities law aside, many KOLs could be violating Federal Trade Commission rules requiring “clear and conspicuous disclosures,” said Givner, the Philadelphia-area lawyer. “The core of the matter is, if you’re receiving compensation to shill about something, it MUST be disclosed so as to not mislead consumers.”

The arrangement leaves retail traders in the dark about KOLs’ financial stake and their ability to sell tokens to very people they’ve been hyping up for launch day.

“You obviously make your community exit liquidity,” Muur said.

Weeding out ‘garbage’

The KOL economy is only becoming more efficient at extracting value. Multiple crypto marketing agencies said they compiled lists of hundreds of KOLs. For a fee, they link influencers to projects where they can make the most impact.

KOLs, too, are evolving. Smaller ones have started forming into syndicates through which they can leverage better deals in KOL rounds, two people familiar with the practice said.

To be sure, not every crypto project runs a KOL round. One KOL marketing executive said 95% of teams get cut for being “random bulls**t.” Only the upper tier of projects can raise from influencers, he said. He chalked this up to credibility: If influencers promote obvious flops, they’ll lose their audience’s trust.

Still, that upper tier floods prospective KOLs with near-incessant pitches. One prolific investor said he gets offers to join KOL rounds “10x a day.” Virtually all of them require promotions, he said. Almost none of them require disclosures.

Projects themselves can afford to be picky about who they use to promote their wares. Or at least, to try.

“We curated 100 KOLs, really took our time to weed out the garbage,” said an executive at one well-known crypto project that recently held a KOL round. “End result, most not all, just want their token to pump and sell as quickly as possible.”

Edited by Marc Hochstein and Nick Baker.