Why Litecoin’s state looks dire ahead of halving

Litecoin’s hashrate has been declining for quite a few weeks, as have its miners’ fees. LTC’s price action also remained bearish.

- Litecoin’s fourth halving is expected to happen on 3 August, at a block height of 2,520,000.

- Though metrics looked bearish, a few market indicators gave hope for a trend reversal.

Litecoin’s [LTC] halving is just four days away, which will reduce block rewards from 12.5 LTC to 6.25 LTC. While some in the crypto space have high hopes from the blockchain ahead of its halving, the broader crypto market seems to have a different opinion.

Litecoin’s price action also remained under the bears’ influence, raising further concerns ahead of the major event.

Litecoin’s halving is less than a week away

To be precise, just 3000 blocks remain until Litecoin’s upcoming halving. As per Nicehash, the event is expected to take place on 3 August. Though this is a major event and several are ambitious about Litecoin, its mining industry has been witnessing a decline.

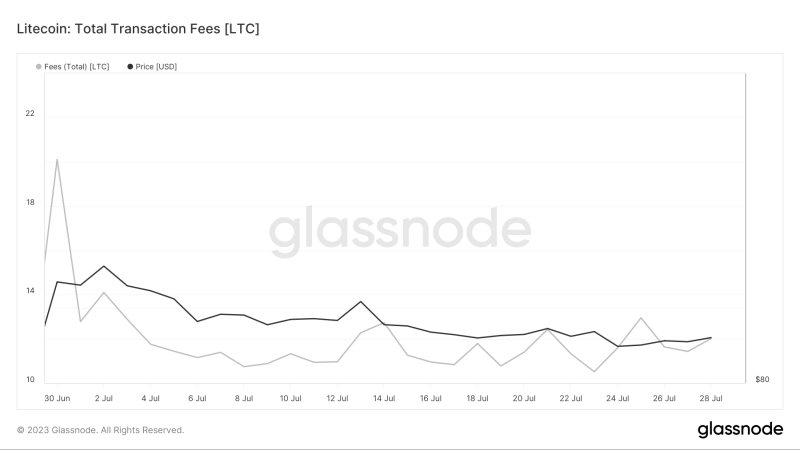

For instance, Coinwarz’ chart pointed out that the blockchain’s hashrate has plummeted over the last few weeks. Not only that, but Litecoin’s miners’ fees also sank, which too was a negative signal for its swimming sector.

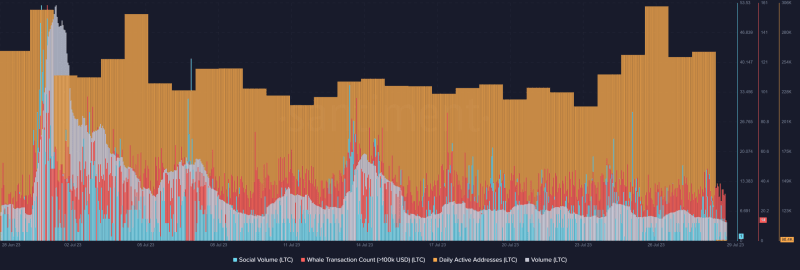

Apart from the number of miners, the blockchain’s popularity also declined. This was evident from the drop in its social volume over the last month.

Whale activity around LTC and trading volume also sank, suggesting that investors were not interested in trading the token at press time. However, LTC’s daily active addresses remained on the upper side.

Should investors expect better from Litecoin?

Like the blockchain’s mining sector, its price action also took a blow last week. As per CoinMarketCap, LTC was down by nearly 3% over the last seven days. At the time of writing, it was trading at $91.03 with a market capitalization of over $6.6 billion.

However, Shan Belew, a popular crypto influencer, highlighted in a recent tweet that a bullish falling wedge had formed in LTC’s price chart. This suggested that the coin might soon witness a bull rally.

I’m bullish on the falling wedge into the halving. pic.twitter.com/VGstu275s8

— master (@MASTERBTCLTC) July 28, 2023

Upon checking LTC’s daily chart, the aforementioned possibility can’t be ruled out. The Exponential Moving Average (EMA) Ribbon revealed that the bulls and the bears were struggling to flip each other.

Litecoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) both moved sideways. If the bulls could beat the bears, then the chances of LTC entering a bill rally would be likely.