Cardano price prediction – Perfect time to buy ADA after 25% dip?

ADA has hinted at the possibility of a price rise. But is it just a short-term rally?

Edited By: Saman Waris

- ADA’s price has fallen by 25% in the last 30 days.

- Readings from key on-chain metrics suggest that now might be a good time to buy the altcoin.

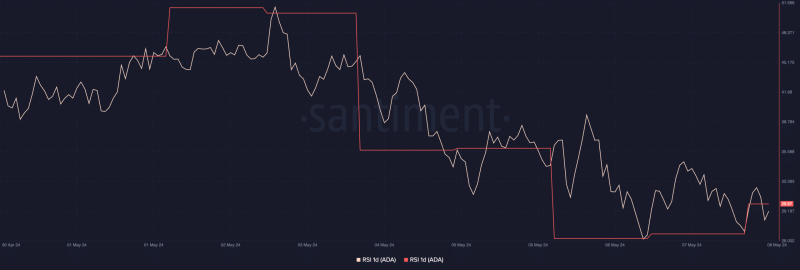

Cardano [ADA] may be due for a price rally as a key on-chain metric flashes a buy signal, Santiment noted in a new post on X (formerly Twitter).

According to the on-chain data provider, ADA’s Relative Strength Index (RSI), which helps its traders identify overbought or oversold conditions, is,

“Notably low compared to other caps, making it a slightly better buying opportunity.”

The RSI is a momentum indicator that measures the magnitude and speed of asset price movements. Traders also use it to track potential trend reversals.

When it returns a value above 70, the asset is deemed overbought, and there is a potential price correction. When its value is “low” and below 30, the asset is oversold, and there is a potential upward price movement.

ADA’s RSI was 29.97 at press time, signaling that the coin was oversold.

Prepare to ape in

To confirm whether the time is right to buy ADA, it is important to assess its Market Value to Realized Value (MVRV) ratio.

This metric tracks the ratio between an asset’s current market price and the average price of every coin or token acquired for that asset.

A positive MVRV ratio above one signals that an asset is overvalued. It suggests that the asset’s current market value is higher than the price at which most investors acquired their holdings.

Conversely, a negative MVRV value shows that the asset is undervalued. It suggests that the market value of the asset in question is below the average purchase price of all its tokens that are in circulation.

When an asset’s MVRV ratio is negative, it offers a buying opportunity. This is because, at its current price, the asset trades at a discount relative to its historical cost basis.

Read Cardano’s [ADA] Price Prediction 2023-24

ADA’s MVRV ratio assessed over different moving averages returned negative values. Per Santiment’s data, the coin’s MVRV ratios on 30-day and 365-day moving averages were -13.55% and -4.5%, respectively, at the time of writing.

ADA exchanged hands at press time at $0.44, per CoinMarketCap’s data.